Buyers need to apply for approval to issue invoices. Following are the due dates for issuing an invoice to customers: 5. How to personalize GST Invoices ? The ClearTax BillBook allows you to create and personalize GST Invoice free. What is a GST invoice or bill?

GST invoice is a document sent to the buyer asking for the payment of the goods or services offered by the GST registered vendor. It holds detailed information about the product or service provided by the vendor. Does signature compulsory on GST invoices? Does Flipkart issue a GST invoice?

When a registered taxable person supplies taxable goods or services, a GST invoice is issued. To issue and receive a GST compliant invoice is a prerequisite to claim ITC. If a taxpayer does not issue such an invoice to his customer – who is a registered taxable person, his customer loses the ITC claim and the taxpayer loses its.

A tax invoice under GST is an important document.

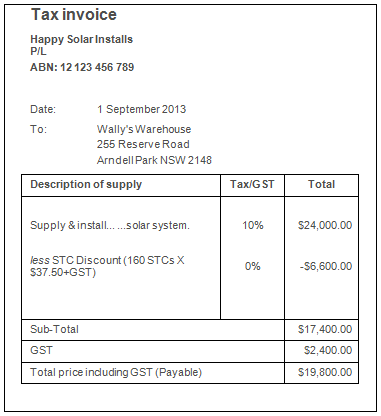

Use online invoice software to grow your business. Free Blank Australian GST Invoice Template. This is the standard invoice format for Australian tax invoices. Change the invoice format via the button below. Add or edit the Taxes or Discounts -if applicable- from the Taxes and Discounts buttons.

The GST law makes it necessary for registered taxpayers to issue invoices for the sale of goods or services. You can personalize your invoice with your company’s logo. This is because the tax invoice not only enables the seller to collect payments, but also avail input tax credit under GST regime. For services, the tax invoice must be issued within days from the date of the service rendered. For goods, it involves two criteria.

It also comes with numerous invoice templates with GST field include to help businesses to choose the invoice that suits their requirements. All GST -registered businesses must issue tax invoices for sales made to another GST -registered business. This is to enable your customer to claim the GST incurred based on your tax invoice. If the value of your supply does not exceed $00 you can issue a simplified tax invoice with fewer details. The GST -compliant invoices account for both the registered and unregistered persons.

Also, Read: Goods and Services Tax ( GST ) – A Simplified Approach To Filing Tax. Importance of Tax Invoice.

The tax invoice is a crucial document under the GST. Create GST Invoices in recommended GST invoice format and share them in seconds with your parties with this best online invoicing software India. Do the gst app download now and always remain 1 GST compliant effortlessly.

Welcome to e- Invoice System. Vyapar has been built by keeping GST. These are the only documents, which are given importance in GST. It removes the prevalent invoicing system that includes Tax Invoice , VAT Invoice , Excise Invoice and a Retail or Commercial Invoice. Under GST regime each supply of goods or services must accompany an invoice or a bill of supply.

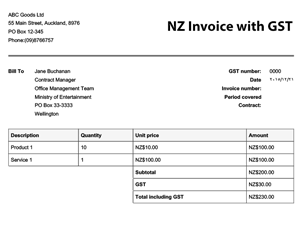

Such a document issued reflects the (i) trading parties, (ii) description and quantity of goods and services, (iii) date of shipment, (iv) mode of transport, (v) prices and discount and (vi) delivery and payment terms. Before the implementation of GST , there were various kinds of invoices active in the system like tax invoice , excise invoice , retail invoice , etc. However, after the implementation of GST , all those different invoices were replaced by the GST invoice. To be able to claim the input tax credit, issuing a GST invoice is mandatory. The GST system has replaced the invoices such as tax invoice , excise invoice and retail invoices with one general GST tax invoice that has to be issued for all sales of goods and services.

As a GST registered dealer, you are obligated to provide invoices that are compliant with GST rules and regulations for all supply of goods and services. Movement of goods for the purpose of export where IGST is leviable, it can be done in the following two ways: Paying IGST in advance and taking the refund of it after the goods are exported. Tax invoices for $0or less.