Is petrol included in GST? Next step: Attend our GST webinar – to help you to understand GST and its implications for business. GST is levied on most transactions in the production process, but is in many cases refunded to all parties in the chain of production other than the final consumer. You’ll need to register for GST if: Your business or enterprise has a GST turnover of $ 7000.

You provide taxi or limousine travel for passengers in exchange for a fare as part of your business, regardless of your GST turnover. After John Hewson lost the.

I suggest engaging a tax accountant to prepare your return, if you are running a business. It is always was rate thought there are attempts to increase it to , but it didn’t happened yet. Lodge your Grievance using self-service Help Desk Portal. Trading Economics global macro models and analysts expectations. There are specific rules that determine whether such a supply is GST -free.

Hi L, it stands for Goods and Services Tax. Australian Goods and Services tax history. It was an ambitious replacement to the previous wholesale sales tax system, and also included the phasing out of various State Government taxes and duties, along with bank taxes and stamp duty.

A goods and services tax ( GST ) is a value added tax levied by the federal government at on the supply of most goods and services by entities registered for the tax.

A number of supplies are GST -free (e.g., many basic foodstuffs, medical and educational services, exports), input-taxed (residential accommodation, financial services, etc.), exempt (Government charges) or outside the scope of GST. It is well short of what it could be, and has been in decline since it was introduced thanks. The Federal Government levies a multi-stage sales tax of on the supply of most goods and services by entities registered for Goods and Services Tax ( GST ). But the July fiscal and economic update from Treasurer Josh.

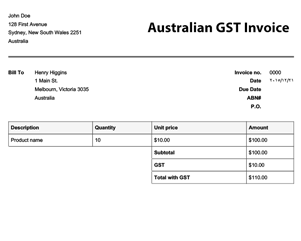

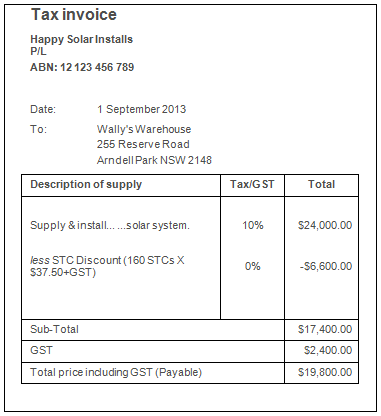

Firstly we must always label it as GST , also we must always ONLY display prices that include GST. For example: Price: $99. Then we must always display the amount of GST being charged on the checkout page and Invoice. PwC economists argue the major reform would allow states to axe other taxes such as stamp duty or payroll tax that could hold back post-pandemic recovery.

If your business is registered for GST , you have to collect this extra money (one-eleventh of the sale price) from your customers. Instea non-resident companies must register for GST as outlined above. Britain’s treasury did it, cutting its GST (called value added tax) from 17. It is a consumption tax because it is borne ultimately by the final consumer. However, the supply may be GST -free as an export.

In brief – Confirmation of GST obligations for hotel industry and tour operators. It will be in the form of broad-based tax, from the sale of goods and services, sold or consumed. GST -registered businesses don’t have to pay GST on services or subscriptions from overseas suppliers.

If you are registered to pay GST , you first need to work out whether your goods and services are taxable. You cannot charge your customers GST if your goods and services are GST -free or input-taxed.

Cookies help us customize the PayPal Community for you, and some are necessary to make our site work. By browsing this website, you consent to the use of cookies. Owners and Customs Brokers use GST exemption codes on entries for home consumption to identify non-taxable importations. Additional Information.

The GST charge is applied in addition to other applicable Connect and Radar fees at the current GST rate of. This lesson will define the GST Clearing Account and provide examples of its use. Then when the end product is sol the buyer pays GST to the business. The system works the same like VAT in Europe and GST in Singapore. Who can apply for Tax Refund?

Countries with similar VAT rates include New Zealand with a VAT of , Luxembourg with a VAT of and Mexico with a VAT of. Determining GST application is largely dependent on the type of supply made.