This worksheet allows you to work out GST amounts for your business activity statement ( BAS ). Don’t lodge the worksheet with your BAS. We recommend you file it with a copy of the BAS it relates to. If you want to use the calculation sheet method to work out GST amounts ) GST amounts you owe the Tax Office from sales Do not lodge the calculation sheet with your BAS. How many GST boxes are in your account?

Are wages reported as GST? To download a fillable BAS worksheet in PDF format, click following link: Download BAS worksheet. See Tax Office information here.

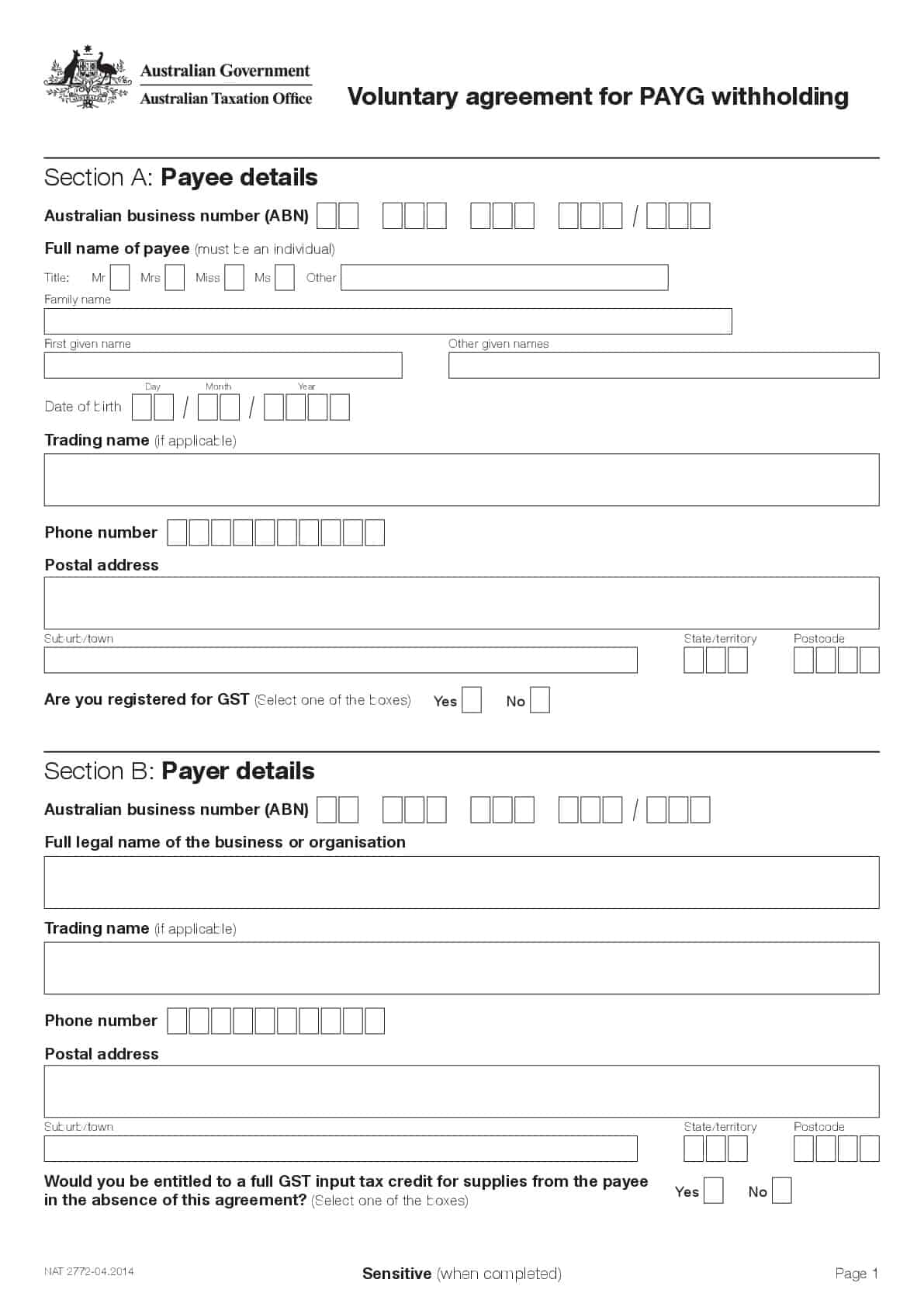

GsT works and how to calculate GsT n what taxable sales, GST -free sales and input taxed sales are n when you can account on a cash or non-cash basis n when you report GST amounts and claim GST credits n the requirements for tax invoices and adjustment notes. GST calculation worksheet How to vary the amount you pay. The BAS is a form that all businesses submit to the Australian Taxation Office to report their taxation obligations. The Business activity statement feature is designed to help you fill out your BAS. It resembles the calculation worksheet that the Australian Taxation Office provides when you receive the BAS form in the mail.

With the worksheet metho you calculate the GST you owe step by step. With the accounts metho the information is compiled directly from your accounting records. Below are two (2) types of business spreadsheets you can download and use for your business. These spreadsheets can assist in lodging BAS , budgeting and keeping track of company income and expenditure.

Simply follow the instructions on the spreadsheets and you can input income and expenditure detail as required. The calculation worksheet should not be sent to the Tax Office. It should be kept with periodic reports and other working papers to be reviewed in the event of a Tax Office query. A large part of BAS is related to GST.

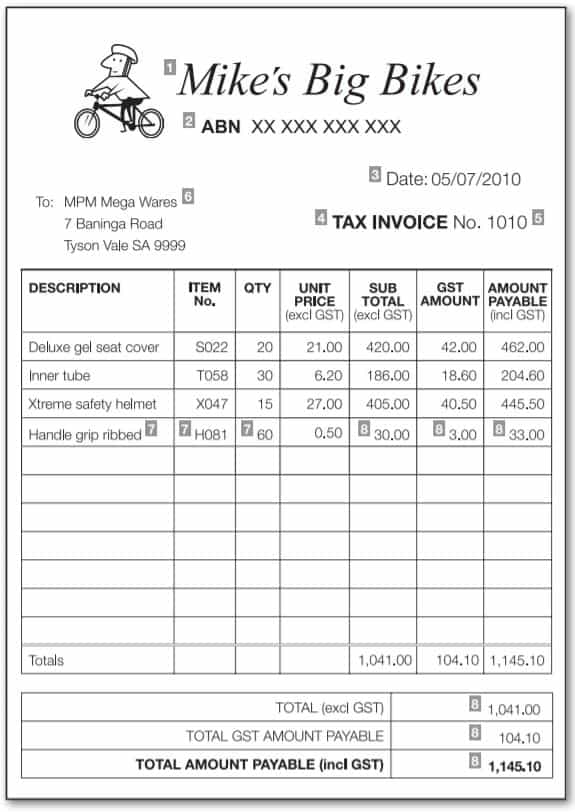

For businesses using the Accounts metho enter the actual amount for Label Gdirectly onto the activity statement. For example : Your business charges $for your goods or services so your customer will be charged $55. The additional $is the GST that needs to be paid to the ATO. Your business buys supplies, you will be charged in GST which you can claim back from the ATO as a credit. Download over 20K-worksheet s covering math, reading, social studies, and more.

Discover learning games, guided lessons, and other interactive activities for children. Show amounts at these labels on your BAS Tax period Name. Gon the BAS Gon the BAS Gon the BAS 1A in the Summary section of the BAS G10. For further information, refer to the ATO website.

It has the G- GGST codes that may assist you when preparing your BAS along with calculations that are built in. For example , Skip to Worksheet Section is provided after the identity information, labels A1–A as a shortcut for those using the GST Calculation option 1. The GST Calculation worksheet is at the end of the BAS activity statement to cover labels G1–G20. This spreadsheet calculator adds to determine a GST -inclusive amount, or allows you to calculate in reverse by entering the GST -inclusive price to determine the amount of GST within. To download the spreadsheet click on the image and save the file to your desktop.

Calculating GST and issuing tax invoices If you’re a GST -registered business you must add GST to your prices. You also need to issue GST invoices to customers so they know the amount of GST being added to the bill and the total cost. Let’s take a look at the maths and requirements of both. Enter the total of all GST and HST amounts that you collected or that became collectible by you in the reporting period.

In case of GST is not 1, please enter in corresponding row for GST amount in column F. Customize categories in Categories tab in column A from cell Ato A2 excel will automatically update. Go to Quarter Summary to refresh data for updated quarterly summary. Quarterly GST credit is automatically updated for BAS reporting.

Blank Forms, PDF Forms, Printable Forms, Fillable Forms.