What is the GST, and how is it calculated? Where, Y is the Original price of the good sol R is the rate applicable and FP is the Final Price. GST Calculation Formula. The base in this example is $1again.

In the example below, we can see that this calculation is slightly harder, but using the formula can be found quite easily. For example, if the tax rate is , divide the total amount of receipts by 1. How to calculate GST. Determine the net price (the price without the GST). It will be in our example.

If expressed in percentages, divide it by 100. Now let’s work backwards. We are going to calculate it together. You should first layout the price before the GST. When a price inclusive the tax is mentione in such cases reverse tax is applied.

Below mentioned is the formula to use while calculating reverse charge. Ram in Karnataka supplies a television to Mr. Shyam in Maharashtra. Ram wants to arrive at the value of tax. Let’s see the calculation in practice.

This is your bill without GST. Disclaimer: The following answer necessarily sets out general principles only. Multiply by divide by 3. The facts of particular cases always need to be considered carefully, and it may be necessary to obtain advice from a tax expert. So we can use a maths rule to simplify the formula.

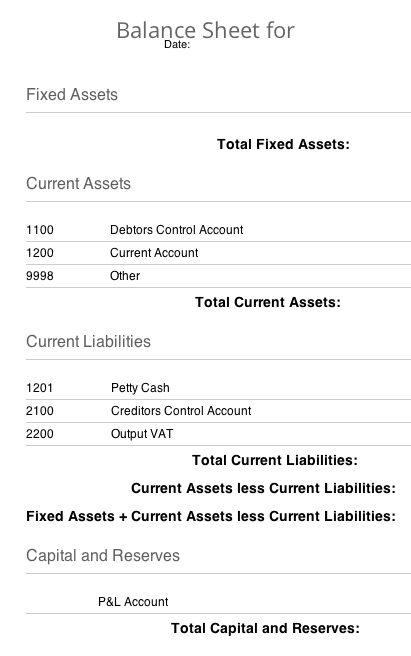

We extract the value and write the rest with parenthesis. In our example, it is 0. Add to the value from Step 1. Divide the Total amount by the value from Step to calculate the product. You will need to transfer amounts from this calculation sheet to the BAS.

Government has notified that till the GSTN portal has not started showing utilisation of input with new rule, registered person has to utilise the input credit as per old rules. So this calculator is 1 correct in current scenario. We have made an effort to ensure the accuracy of this calculator , we cannot be.

International transport and insurance (TI) = $ 150. In New Zealand Goods and Services Tax is a value-added tax that is paid across all goods and services that are taxation liable. I can use in 1- calculation to obtain the pst and gst ,,i.

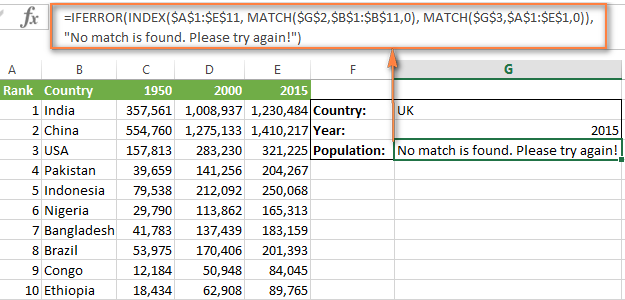

FROM the total invoice eg. Make sure that none of them have any errors. The first input is the product net price. To download the spreadsheet click on the image and save the file to your desktop.

Click here to download. Download GSTR 3B Calculation Sheet. China VAT Calculator.

Initially, the standard VAT rate of was collected for exports and imports and reduced rates of and was collected.