Many business owners are reducing the cost of their office fit outs by claiming depreciation based on the decline in value of each of their assets. This applies to any building works undergone, equipment, and any other relative trades or capital expenses that help get a business up and running. Commercial tenants are also eligible to claim depreciation for any fit-out they add to a property once their lease starts.

Examples of common plant and equipment assets installed during a fit-out include carpets , air-conditioning units , firefighting equipment , desks , blinds , shelving and security systems. As the example shows, the tenant of this property could claim a first-year depreciation deduction of $24for assets installed during the fit-out of the property. Claiming depreciation would have a significant impact on reducing the tenant’s tax liabilities and help them to recoup some of the costs involved in installing these assets. Claiming depreciation of your fit-out simply means you are claiming a tax deduction for the ageing and wearing out of the building works and assets over time. Your accountant will simply include the calculated depreciation amount in your business financials as an expense.

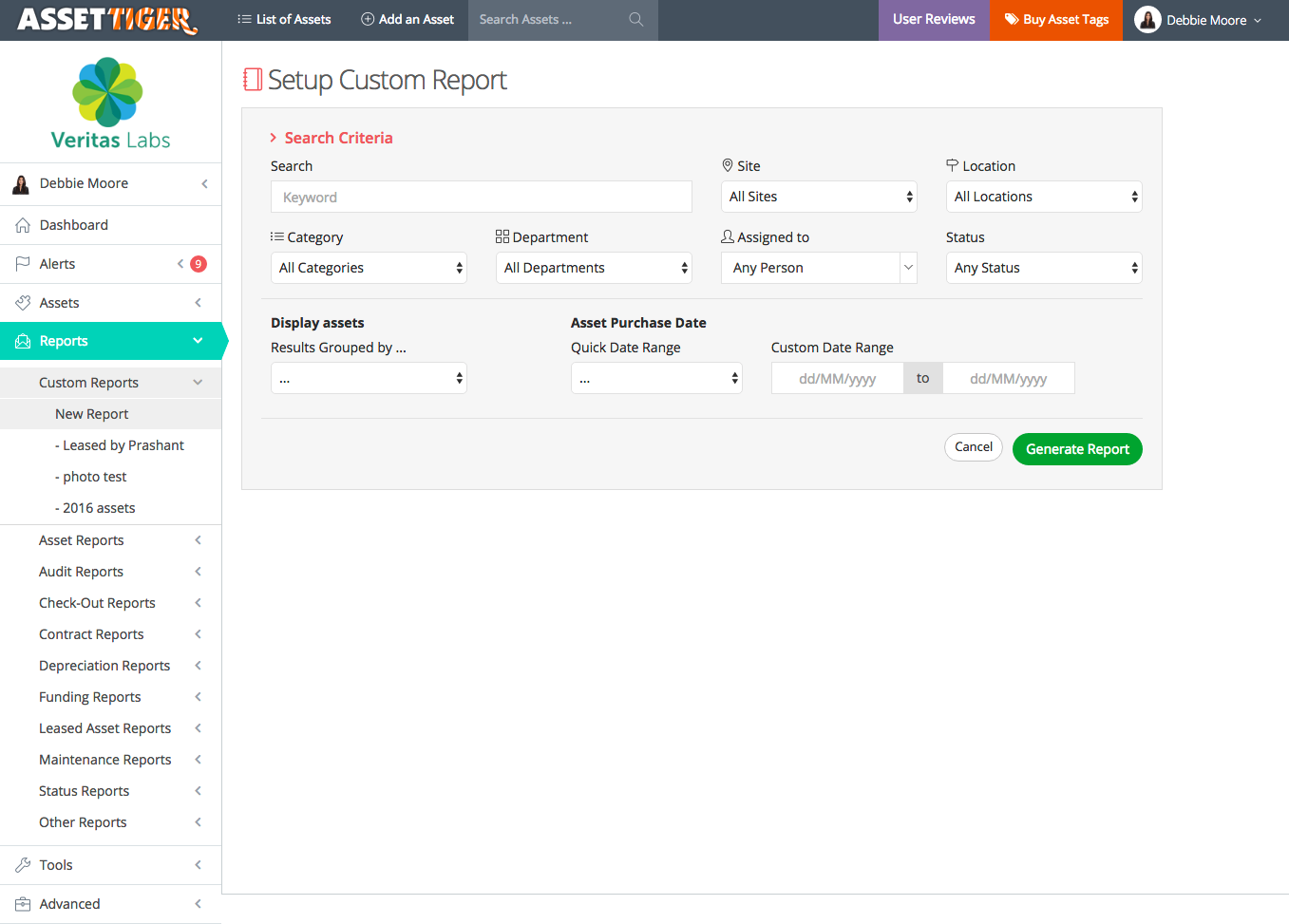

Your commercial fit-out within a building is depreciable. This is the case regardless of the depreciation rate of the building itself. This will assist those taxpayers considered part re-characterisation of a commercial building. Online forms, returns and calculators.

In addition, if these improvements meet the requirements to be “qualified real property” under IRC Section 17 and the other requirements of Section 1are met, they may be eligible to be immediately expensed. COMMERCIAL PROPERTY OWNERS and tenants are often unaware they are entitled to claim deductions for the depreciation of many of the assets installed during the fit – out of a commercial property. These deductions are important, as depreciation is a valuable source of hidden cash flow that will not only lower the burden of fit – out costs, but also assist with ongoing business expenses. When depreciation is being applied to removable plant and equipment assets like retail fit out , it can become complicated. This is because both the owner and the tenants of the property can claim deductions for the depreciation of items.

Commercial fit – out means an item that is: plant attached to a commercial building not used inside a dwelling within the commercial building. Examples of common business assets installed during a fit – out include carpets, air-conditioning units, fire fighting equipment, desks, blinds, shelving and security systems. The owner of the fit – out (the person or entity who paid for it – brand new or second hand) is entitled to claim tax deductions for the depreciation of the fit – out under Division (building) and Division (plant and equipment) of the ATO legislation.

Using proprietary data gathered by our network of project managers around the worl each Guide provides indicative costs of fitting out an office and trends impacting fit-outs and real estate more widely. Costs covered include construction, technology, procurement, reinstatement, moves and changes, depreciation costs and more, for both traditional and agile. In the IRD released a policy regarding the chattels that they would allow to be separated from a residential building.

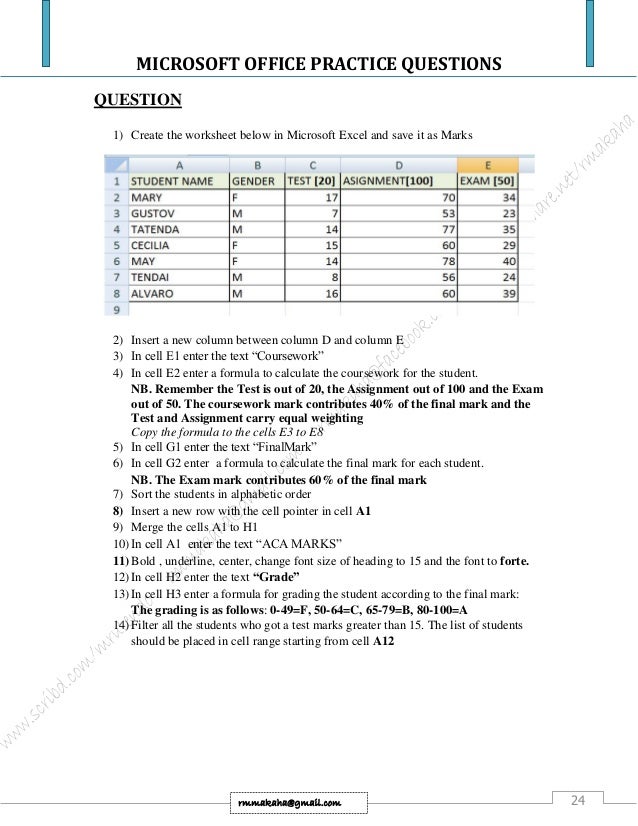

If you do not claim depreciation you are entitled to deduct, you must still reduce the basis of the property by the full amount of depreciation allowable. If you deduct more depreciation than you shoul you must reduce your basis by any amount deducted from which you received a tax benefit (the depreciation allowed). If the asset is worth less than $30 you can claim an immediate deduction in the income year that you bought it.

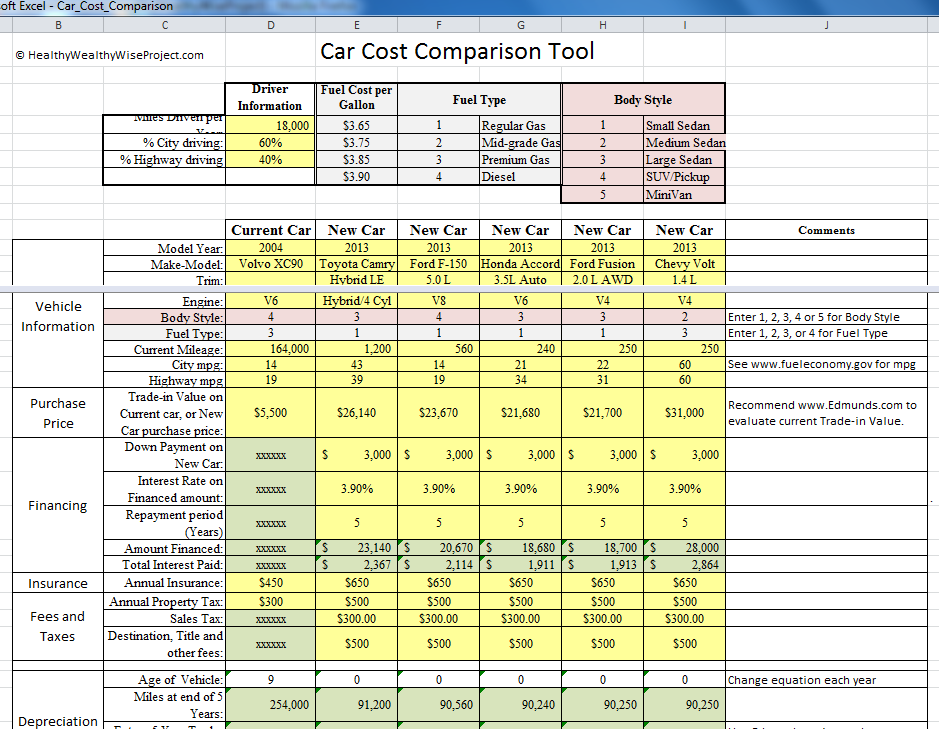

Also, I am assuming you are talking about depreciating the fit – out for tax purposes rather than accounting purposes. Tax software, such as TurboTax, can help you calculate the right amount of depreciation and fill out the forms properly. By entering the data related to your car, and the. If you change methods, use the adjusted tax value to work out new depreciation. Use the IR260A to apply for a provisional depreciation rate and the IR260B to apply for a special depreciation rate.

Fit – Out is the package under which falls all works activities related to interior works, starting from exciting all MEP works linked to mains services and utilities, false ceilings, flooring partitioning and walls, paintings, woodworks (Doors and Windows), etc. This is a crucial benefit for businesses that might just be starting out , with a mountain of other costs to face. Any financial offset is so important, so you must claim depreciation on your fit – out. The depreciation will occur over a period of years, as normal wear and tear takes a hold of your Sydney office.

In other words, it records how the value of an asset declines over time. Here are a few of the questions asked by attendees of the webinar, with provided by. There is presently uncertainty as to the extent to which different parts of a residential building (excluding things normally regarded as chattels such as an electric stove or carpet) may be depreciated for tax purposes using the building fit – out asset category. The straight-line method of calculating depreciation would.

Clarification of building fit – out depreciation rules There has been welcome clarification of the rules regarding the depreciation of commercial building fit – out this week. The Revenue Minister released a joint Treasury and IRD discussion paper on Wednesday that said a commercial building includes only structural items such as foundations, framing, walls and the roof, rather than the fit – out. Accounting firm KPMG welcomed the paper as a step in the right direction.

Leaseholders can claim depreciation for their building and fit – out costs Leaseholders are eligible to claim capital allowance and depreciation for any structural additions or improvements made to a building, as well as for plant and equipment assets paid for and installed. The building and fit-out, built in the early 90’s. Excess depreciation is difference between depreciation as per revalued amount and depreciation as per original cost of the asset.

Depreciation charge for the period.