Is promissory note a promise? The promise to pay must be. See full list on playaccounting. It must be signed by the maker. Promise to pay must be unconditional.

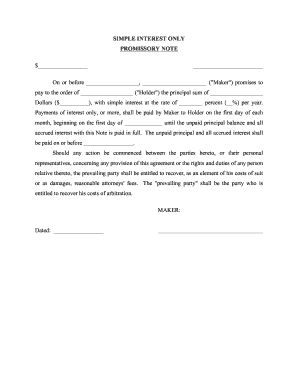

The amount of payable must be certain. Amount must be expressed in terms of money only. Acceptance is not required. Here are some features of these notes.

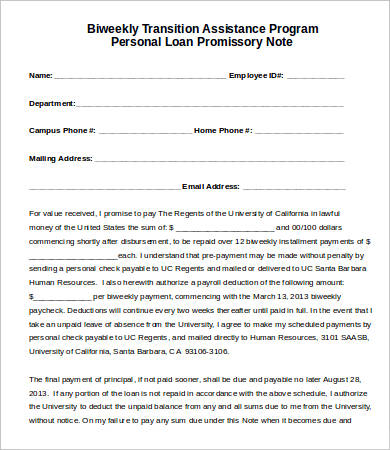

This signifies that promissory notes are not just a simple acknowledgement of paying a certain sum within a specified time. There must be a clear and unconditional promise to pay a certain sum to a specified person or on-demand. It is a written document.

It specifies the name of the maker and payee. The sum payable must be certain. A promissory note is a written and signed promise to pay back borrowed money.

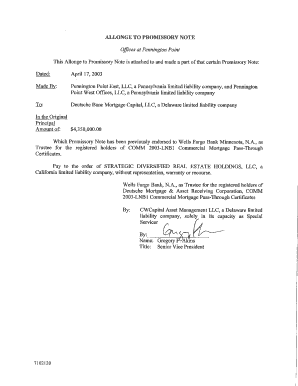

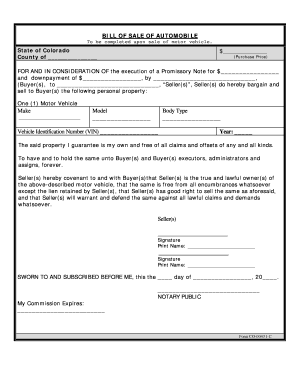

Indication of the date and place of issue. Signature of the drawer (payer). You may also check out what is a note. Simplicity and flexibility are two primary advantages of using a promissory note in lieu of a loan. There are types of promissory notes, secured and unsecured.

The date on which the note is payable should be fixed. Remember, a promissory note is always in writing. If Ken gets a loan from a friend and doesn’t have a written agreement, it can’t possibly be a promissory note. Each promissory note is unique, features its own terms, problems and wording.

The note’s interest rate may be too low in comparison to market prices. The value of the collateral should be equal to or greater than the principal of the debt. An unsecured promissory note requires no collateral to borrow. It classifies negotiable instrument into broad types, i. Inland Instruments, Foreign Instruments and Bank Drafts.

While cheque in an order to make payment in one time. If you decide to lend money to someone, you may want to create a promissory note to formalize the loan. A signe valid promissory note must be signed before loan funds can be disbursed. There is no need of acceptance since the payor is himself the maker of the note.

The document also explains the terms and conditions of the loan. It can not be an oral promise, as an oral promissory note as scarcely seen as valid and legally bind. How is it different from other negotiable instruments?

When you use promissory notes as payment for vendor invoices, you debit the vendor account. What is a promissory note ? You will typically settle the invoice with the promissory note on the due date. In the context of a mortgage foreclosure, the.