Do you need to register for GST? What is the tax requirement for sole traders? How much do sole traders pay? What does GST stand for in business?

If you’re confused by the concept of GST, you’re not alone. Many freelancers and sole traders in Australia aren’t sure if they need to register for GST, or how to calculate it and charge clients appropriately.

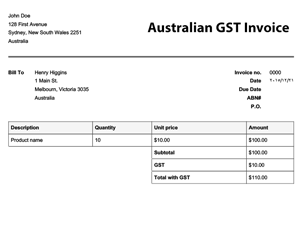

GST is tax placed on most goods and services sold in Australia. If you earn over $70or drive a taxi, you will need to register for GST. A sole trader is not automatically required to register for GST. Only once you have (or expect to have) annual revenue of $75k or more are you required to register for GST. Does having an ABN mean I have to submit a separate tax return?

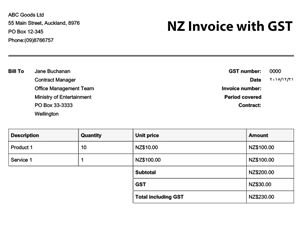

Not all sole traders need to register for and pay GST but in general if you earn over $70per financial year or drive taxis you can’t avoid it. You’ll need to tell Inland Revenue you’ve become a sole trader and you’ll need to register for GST if you earn over $ 60a year. You can also get a New Zealand Business Number (NZBN), a unique identifier, which any business in New Zealand can now have.

See full list on smallbusiness.

If you choose not to use your own name you will need to register a business name with the Australian Securities and Investments Commission. You will need to get an Australian Business Number (ABN) before applying to register a business name. It is free to apply online for an ABN with the Australian Business Register. Sole traders are taxed as individuals and pay income tax at personal rates.

Liability is unlimited and includes all personal assets, including any assets jointly-owned with another person, such as a house. You are also not covered by workers’ compensation should you injure yourself at work. This may result in a loss of income if you cannot work and you may still be required to pay any expenses for your business, such as loan repayments. Learn more about the various insurancesavailable for your business.

It is the simplest kind of business structure. The owner of a sole proprietorship has sole responsibility for making decisions, receives all the profits, claims all losses, and does not have separate legal status from the business. For Sole – Traders you need to have lodged your previous years tax return or BAS, so last years tax return for us.

Currently running a small business (online store) on the side, just starting out. For more information regarding tax obligations for sole traders visit the ATO website. A business with high service-based sales and minimal expenses and capital purchases may benefit from not being registered for GST , if that option is available to them.

For example, a GST -registered business with an income of $70excluding GST , and outgoing of $10excluding GST , would be required to remit $0collected GST to the ATO. I only do an annual BAS though and just pay my GST bill in one go. Self-employment includes contracting, working as a sole trader and small business owners.

You need to register for GST if you earn over $60a year.

I have just opened my own clinic but I only work there part-time. Goods and Services Tax. If you are operating a business as a sole trader and have a GST turnover of $70or more, you are required to register for GST.

If your business or enterprise does not meet this requirement, registering for GST is optional. GST on the invoice – which i have included in the entry When I look at balance sheet it shows GST colected and GST paid – as a liability. Should I just journal out this liabilty as at year end or is there another way.

You may not need to register for GST if the only sales you make are made through an electronic distribution platform. You can find more about tax on retail sales of goods and services into Australia on the ATO website. Need to report the video? Unless your revenue is mostly comprised of GST -free sales (perhaps if you are a doctor), having to register for GST will probably be bad for you because the GST on sales amount that you will need to remit will generally be greater than the amount of GST on expenses that you can claim, resulting in a net payable amount. I don’t need to register for GST.

You are a small supplier. I am not registered for GST. You may choose to register voluntarily if you make taxable sales, leases, or other supplies in Canada. You do not have to register. Hi, I have a customer (who also supplies us with services) who is a sole trader , not registered for GST.

The meaasge says that Import Duty and Input Taxed ar.