What is CPF contribution? How does the CPF work? As a result, members aged and above will earn up to interest per year on their retirement balances. Special Account – Up to 5. Another extra of the first $30is also given to those and above.

Important Notes This form may take minute to complete.

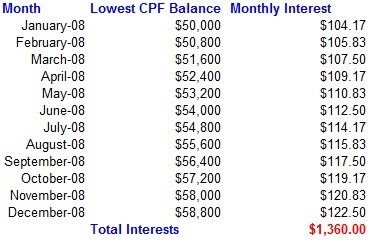

For those with large CPF balance say $5000 the extra interests are insignificant. In other words, bank account interest rates tend to be low, so they most likely can’t effectively hedge against inflation. Fortunately, the money in a person’s CPF account earns interest too. However, the rates are much better than your typical bank account.

Take a look at the interest rates at the moment. People would consider this as a better alternative of investing money than stock-related instruments and those offered by insurance policies. Ordinary Account – 2. CPF interest rates are reviewed every quarter.

EPF Interest Rate Chart.

OA and for other accounts. CPF members who have questions may visit cpf. So, one month’s interest rate = 8. However, many wealth builders prefer the predictability of having a return that is passive. Singapore Government bonds. There is an additional paid on the first $60of your combined CPF balances, with up to $20from the OA.

You can also check out the CPF Withdrawals Limits Calculator to understand how much CPF funds you can use to pay for your home as well as the Total Interest Calculator to estimate the total interest you will eventually pay on your home loan. The extra interest , 2. This concessionary interest rate is pegged at 0. These are the concessionary interest rates for quarters: Quarter. Concessionary Interest Rate. When calculating interest , is = 8. Correspondingly, the concessionary interest rate for HDB mortgage loans, which is pegged at 0. OA interest rate , will remain unchanged at 2. Because the first $60is earning an extra , your effective interest rate on your CPF will always be above.

Use it at your own risk! Please leave a comment if you have any feedback on the calculator. It is evident that Heartland Boy’s mum has ample headroom to take advantage of the additional extra interest rate () and extra interest () paid on the first $30of her combined CPF balances.

CPF Members currently earn an interest of 2. Penalties for not paying CPF. If you don’t comply with the CPF Act, you may be liable to: Late payment interest charged at per annum ( per month), starting from the first day of the following month after the contributions are due. SRS account only generate a nominal interest of 0. Consider RA high interest rate , I prefer to option BASIC plan even though monthly payout less a bit (not significant).

THE interest rates on Central Provident Fund savings are better than what similar financial products in the market offer, said Manpower Minister Tan Chuan-Jin yesterday. Still, the Government will look at how the returns can be improve Mr Tan assured Parliament. Using an interest rates table, the usage of $400k multiplied by 1. Your OA savings earn up to 3. SA and MA savings earn up to. Things to take note: For the first $30of combined CPF balances, an extra interest will be given.

This is on top of the existing extra interest on the first $60of combined CPF balances. Unlike funds in our CPF accounts, that generate risk-free interest of between 2.