What are the qualifications of a company director? What is the legal requirement for a director? Can a director of a company and the company secretary be the same person?

Education and training in the business. A private company or proprietary company will need to have at least one director who must reside in Australia. On the other han a public company will need to have at least three directors, two of which must reside in Australia.

If your company has registered a class of its equity securities under the Exchange Act, shareholders who acquire more than of the outstanding shares of that class must file beneficial owner reports on Schedule 13D or 13G until their holdings drop below. See full list on sec. Section 13(k) of the Exchange Act prohibits SEC reporting companies from making personal loans to their directors and officers. Loans made in the ordinary course of business at market rates by issuers that are financial institutions or in the business of consumer lending are excepted from the prohibition.

The Accounting and Corporate Regulatory Authority considers an individual a director when he occupies the position of a director regardless of the designation of his role or when other directors act in accordance with his directions. ACRA’s definition of a director is crucial because a person not accorded the formal title or designation of a company director, but so acts in such capacity, will still be deemed as a company director, thus required to comply with the Companies Act and may be held liable when circumstances so warrant. The definition set forth is inclusive and likely includes de facto directors, independent directors, executive directors, substitute directors or shadow directors. Who can be appointed as company director ?

A director must be a natural person. Among those considered unfit to become a company director under Section 1of the Companies Act are as follows: 4. Imposed upon a company director are various duties, arising from both the Singapore Companies Act as well as common law. Under the Singapore companies Act, a director is required to: 1. A situation may arise where a director is more beholden to the other entity (in view of his material interest) and acts in conflict with his duties as a director of the company.

Should you have problems looking for a resident director , you can engage companies offering nominee director services in Singapore. Under section 1of the Companies Act, a dire. As a nominee director , Corporate Services Singaporecan help you comply with the statutory requirements under the Companies Act, without ever wrestling control from you or delving into the finances of your company.

Contact us today for a free quote! Section 1of the Companies Act changes the requirement that at least one of the directors be resident in the EU. He must make decisions objectively and in the best interests of the company.

Every company must have at least director who is locally resident in Singapore. Here are the basic requirements for a company director. You must provide your signed consent in writing before being appointed as a director and the company must keep this written consent and update ASIC whenever there are key changes to the company, including the appointment of a new director.

If the company is a proprietary company (has ‘Pty’ in its name) it must have at least one director, who m. Before becoming a director, you should fully understand your role and legal obligations regarding the management of the company. Don’t become a director at the insistence of others, or on the promise that you will not have to do anything.

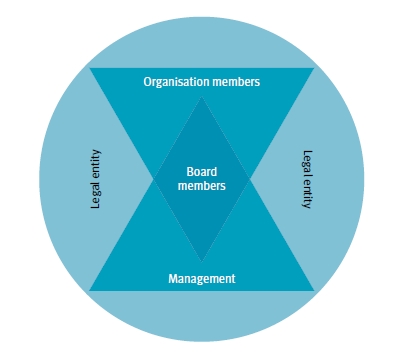

A company is a separate legal entity – that is, it exists under the law in its own right and can do nearly all of the things that a normal person can do such as enter into contracts, borrow money, and buy and sell assets. Because the company exists as a separa. Members of a company, commonly referred to as ‘shareholders’, collectively own the company. Each type of company must have at least one member and the minimum number of directors (i.e. one director for a proprietary company and at least three directors for a public company). So, proprietary companies must have at least one director and one member.

A proprietary company must have at least one director who ordinarily resides in Australia. It is possible to have a single director who is also the sole member of a proprietary company. The sole director and member of a company is responsible for managing the company’s business and may exercise all of the company’s powers. Similarly, a sole director and member of a proprietary company can appoint another director (by recording the appointment and signing the record).

Even the sole director and. Removing a company director 3. Legal requirements for companies 4. Some ways a director is automatically disqualified includes when he is: 1. Director liabilities when things go wrong 2. He or she normally sits on the board to offer objectivity, prestige, outside experience or independent judgement of the company’s management 3. The constitution of the company will usually prescribe the procedure for the appointment of directors. The directors of a company may be appointed by an ordinary resolution passed by the company’s shareholders in a general meeting. An ordinary resolution is a formal decision passed by at least majority of the votes cast at a meeting.

Read our other article for more information on director’s duties in Singapore. The company may pay fees to its directors for the directorial services they perform for the company. The Companies Act does not provide for a specific cap on the amount of fees that a director can be paid. However, as mentioned above, directors’ fees must be approved by the shareholders of the company. Additionally, executive directors who are also employees of the firm would be paid a salary according to the terms of their contract of service (i.e. employment contract) with the company.

In the case of public companies, shareholders’ approval is required for the removal of directors. PSC) details You can hire other people to manage some of these things day-to-day (for example, an accountant) but you’re still legally responsible for your company’s records, accounts and performance. There are other duties you must perform as a company director. These still apply if: 1. Managing directors work in a variety of industries, including companies and enterprises, restaurants, brokerage firms and government. A bachelor’s degree in business administration or related.

For example, you must: 1. Assessing, managing, and resolving problematic developments and situations. Very strong crisis management skills will also be essential since the managing director is the one expected to “save” the company in times of need. The goal is to ensure the company is constantly moving towards fulfilling its short-term and long-term objectives and does not diverge from its strategic guidelines.

The directors of the BV have collective powers and responsibilities. If a company ’s accounting records are kept at a place outside Hong Kong, the accounts and returns with respect to the business dealt with in those records must be sent to, and kept at, a place in Hong Kong. Therefore, it is important for business owners to be acquainted with the requirements and process to be appointed as a director of a Singapore-incorporated company.

Your company must have at least one director.