Your profit and loss statement (PNL) versus your balance sheet: Both of these are financial statements that companies issue on a regular basis to demonstrate the financial health of their business. A profit and loss statement breaks down the revenues, costs, and expenses incurred during a specific period of time. My coffee shop ’s savings receive 1. It includes all of the lines above it, even if they aren’t taxable.

Taxable profit – This shows profit before tax, but only includes lines which can be taxed.

There are 20coffee shops in the U. The problem is that most startup coffee shops fail. If they don’t fail they tend to struggle along and just reach breakeven. Excel and example and sample. You calculate your net profit or loss by subtracting both the labor costs and the operating costs from your gross profit. Your revenue obviously needs to be higher than all your combined costs for you to generate a profit.

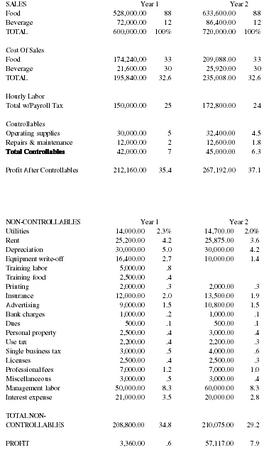

Overall, as the company gets established in the local market, its net profitability increases from 17.

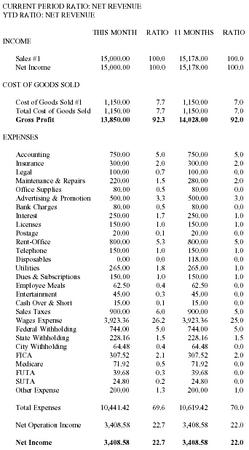

Restaurant Profit and Loss Statement Definition. A restaurant profit and loss statement is a monetary statement that lists the sales, costs, and expenses of your restaurant in a set period of time. In other words, your PL functions as a bank statement for your hospitality organization to monitor your company’s financial health. Calculating the profitability of most food service establishments comes down to basic fundamental business components: increasing sales or margins (revenue) and reducing costs or expenses. Knowing the four basic financial statements is an important first step to owning a restaurant business.

Financial statements will be completed for every quarter as well as annually. The four financial statements are the profit and loss statement , the balance sheet, the cash flow statement and the changes in equity statement. IMPACTS TO THE PROFIT AND LOSS STATEMENT Impacts to the Profit and Loss Statement Tim’s Coffee Shoppe will benefit greatly from several large businesses moving around the coffee shop.

According to Tim’s income statement the profit earned was really good. The new businesses will increase the volume of business that the coffee shop will have as well as the increase of customers. With these changes there will be positive and negative effects on the business. The Coffee Shop business plan, startup and operating course, provides an extensive set of template, example and sample documents for starting and running a Coffee Shop business and contains lectures on how to customize them.

What you get in this course are: 1. A full business plan template for a Coffee Shop business. Projected Profit and Loss. The Daily Perc is expecting some dramatic growth in the next three years, reaching healthy sales and Gross Profit Margin by the end of the first year.

Expenses during the first year will, however leave a Net After-tax loss. This loss will provide TDP with a tax loss carry-forward for the second year. This is the most recent record Tim has. This year, several large businesses are moving in around his coffee shop and he expects business to increase. The level of investment varies according to the size and infrastructure, but you can be sure to quickly and fully recover your initial startup capital.

Cost of goods sold:COGS represents the cost of creating a product or service. For example, a cup of coffee from the coffee shop will include the cost of the paper cup, the sleeve and any other costs involved in making a cup of coffee. A well-designed sample of the coffee shop business plan contains not only useful ideas but also a revenue model with the cost of goods sol equipment costs and needs, profit and loss statements , sales statistics.

With the space to fill in its weekly information over the five-week perio it is very ideal for the recording profit and loss over the one month period. Find out the revenue, expenses and profit or loss over the last fiscal year. Operating income for a coffee shop can average 2. The average coffee shop worker can generate $50in annual revenue.

Total Startup costs: $20– $4000. And by saving your employees time, you can ensure that they are available to keep your customers happy and coming back.