Fees are similar to Liberia and Panama. What is the meaning of BVI? Below are some key features and reasons why it is that much preferred. Additionally, one may use it to defer taxation and minimize liability when trading companies. The registration of an approved company name usually takes one business day.

Ordering a ready-made company (shelf company ) does not necessarily mean that the documents will be shipped out immediately.

If You are a new client, our usual Know Your Client procedures will have to be complete and payment will have to be made. See full list on marburys. Under the ES Act, economic substance is assessed by reference to ‘financial periods’, usually a year in length.

For all other entities, the first financial period starts on the day of incorporation or formation. However, a legal entity may apply to the ITA to alter its financial perio ie to bring it in line with its financial year end. Each of the above activities is defined in the ES Act and we have put together a summary tableof the definitions.

Such entities will be required to provide evidence of their tax status to support their claim. Where an entity makes such an application, the ITA has specified in the Rules, that the reasonable period in which to provide the applicable evidence is two years (inclusive of the financial period for which the entity has applied the treatment). This will assist those entities for whom their financial period spans two financial years.

Further regulations concerning filing format and submissions periods are currently being drafted by the ITA and Marbury will update this guide once the information has been published. The Rules describe a three-stage approach to enforcement whereby upon the initial determination that a legal entity is non-compliant, the ITA will issue a notice and indicate steps to attain compliance, accompanied by a minimum USD0fine. Striking off the legal entity will be the ultimate recourse. The ES Act and the Rules rely on a self-reporting regime, pursuant to which registered agents are required to take steps to collect the economic substance information from clients, and clients are required to provide the required information.

Shareholders holding in aggregate of the issued shares in a British Virgin Islands company may direct the company to compulsorily acquire the shares of the remaining minority shareholders. The European Union announced that it recognises the British Virgin Islands as a cooperative jurisdiction. This is because of the confidentiality and privacy of the company regulations, low taxation and flexibility managing corporate structures. If you agree to accept our use of cookies, click the I Agree button. BVI Company Profiles.

The British Virgin Islands offer distinct advantages over other jurisdictions. It should be noted that. PRELIMINARY PROVISIONS. Short title and commencement. Meaning of “ company ” and “foreign company ”. INCORPORATION, CAPACITY AND POWERS.

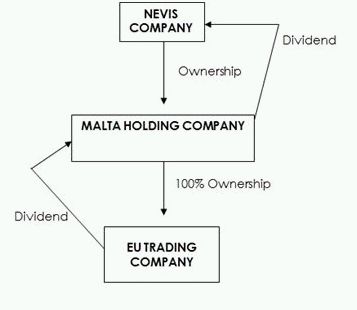

ROAD TOWN, TORTOLA, British Virgin Islands and is part of the Investment Firms Industry. Under a Share Mortgage, the lender receives certain deliverables, to allow control of the company on enforcement. A holding company can be established and used to hold the shares of subsidiaries located in high tax countries.

Also, when a person owns assets or porperty in a territory which is not his domicile, then he can protect his assets against inheritance tax and higher rates of taxation by placing them in an offshore investment company. A quarter of property in England and Wales owned by companies abroad is held by business’s registered in the British Virgin Islands. Theses 20properties (more than any other country), are owned by 17registered business in the BVI.

The analysis of Land Registry data on overseas property ownership by BBC concludes this. Benefits of the British Virgin Islands : Extremely low tax: The purpose of an investment company or a financial holding operation is, of course, to maximise your profits. Therefore, it makes sense to launch this sort of company in a place where you can lower the overall tax you pay.

If you need a recorded and regulated structure in a well-reputed jurisdiction for trading purposes, then other more established jurisdictions, such as. It’s an excellent “ company ” jurisdiction. Alternatively you can incorporate your company without traveling to the British Virgin Islands. As a BridgeWest client, you will beneficiate from the joint expertize of local lawyers and international consultants.

A share in a company is personal property. It is also very popular for many in the Americas.