Determine the value of your company by entering in financials. Two of the most common business valuation formulas begin with either annual sales or annual profits (also known as seller discretionary earnings), multiplied by an industry multiple. In many cases, the value of the intangible assets exceeds the value of the tangible assets, which can result in a major amount of arguing between the buyer and seller over the true value of these assets.

How to value a business? There is no perfect valuation formula.

Your recast balance sheet shows a net current asset value of $800 and a net long-term asset value of $20000. So, the minimum or base price for your business should be $280— the market value of your assets. Get the software that does the job.

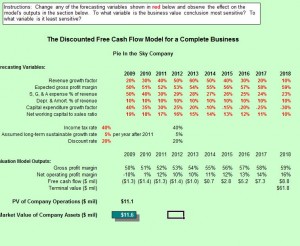

A computational procedure used to determine the value of a business. Depending on your reason for valuing a business , you have several options for coming up with a basic company worth. If you need to sell the. Similar to bond or real estate valuations, the value of a business can be expressed as the present value of expected future earnings.

No need to spend time or money on a business valuation firm.

Just enter in the information on our valuation spreadsheet and our software will calculate the value of your small business. The formula we use is based on the Multiple of Earnings method which is most commonly used in valuing small businesses. At the most basic level, business valuation is the process by which the economic worth of a company is determined. As we mentione there are different approaches to evaluating the value of a small business , but generally, each method will involve a full and objective assessment of every piece of your company. See full list on fundera.

With all of this in min let’s explore some of the most common business valuation methods. Although understanding the different business valuation methods is important, if you do need to evaluate the worth of your business, it’s best to work with a professional. Although the approaches may seem simple enough on the surface, as we saw with the DCF example above, there are extensive and complex calculations involved in determining the value of a business.

This being sai not only will a professional be able to offer you an objective examination of your business, but they’ll likely be able to combine multiple business valuation methods to get you the most thorough sense of what your business is worth. Therefore, if you need a business valuation professional, you’ll want to know where to find one. Generally, you’ll want to look for an individual who is a certified business valuation professional.

The American Society of Appraisers (ASA) offers this certification, as does the American Institute of CPAs (AICPA). You might use either of these organizations as a resource for fin. At the end of the day, business valuation is complicated—especially considering the different methods that are available to evaluate your business and determine its economic worth.

Overall, it’s safe to say that one approach isn’t necessarily better than another, instea the best assessment of your company will likely come as a result of combining multiplebusiness valuation methods. This being sai if the time comes where you do need a small business valuation, your best course of action will be to hire a professional appraiser—as we’ve discusse this individual will be able to offer the most thorough and objective evaluation of your company. Asset-based Drawbacks An asset-based approach is a great comparative tool that a buyer can use to compare with a seller’s asking price to judge whether or not it is realistic.

More customers or products mean more tax liability. State auditors are on high. Alert now that economic nexus is in effect. Learn the ways growth complicates sales tax. Valuation is used by financial market participants to determine the price they are willing to pay or receive to effect a sale of a business.

The idea is similar to using real estate comps, or comparables, to value a house. This method only works well if there are a sufficient number of similar businesses to compare. The discounted cash-flow analysis is a complex formula that looks at the business ’s annual cash flow and projects it into the future and then discounts the value of the future cash flow to today, using a “net present value ” calculation. Industries usually come up with their own rules and formulas to value a business.

Use the return on investment method to calculate value. Bob Adams’s Simple Valuation Guidelines. Based on this valuation , the entrepreneur can justify the deal for a stake in the business for a $10000. The net asset value is identified by subtracting total liabilities from total assets.

The valuation process involves research and observation — whether the prospective enterprise is operating successfully or is functioning as a troubled company.