What is an example of a business trust? What are the benefits of a business trust? Examples of Business Trusts Grantor Trust. Individuals may manage their wealth and provide for their heirs by instituting trusts.

When the parent company does not retain direct management of its business trust , the IRS looks to see if.

Trusts are real property , or assets , or both, which are overseen by someone appointed to manage the interest for the beneficiary. See full list on upcounsel. Business trusts differ from corporations because they derive their status from the voluntary actions of the people who form it.

There is no state charter that gives it any sort of legal status. In some states, business trusts must follow a law of trusts while other states lo. There are several different types of business trusts to familiarize yourself with: 1. Grantor trusts: These have three parties (grantor, trustee, beneficiary) and manage their own wealth and provide for their eventual heirs.

A simple trust is a requirement in order to distribute their entire profits.

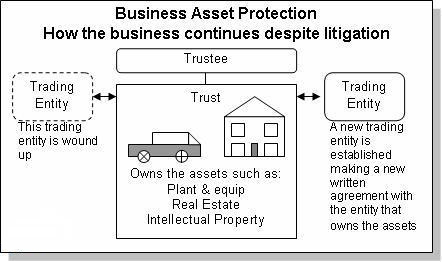

This concept is also applied to a business trust. A business trust is set up when the assets and property of a business corporation are entrusted to an appointed trustee. A Grantor Retained Annuity Trust shields a business or other assets from some or all estate taxes. When the trust ’s term ends, income payments end and beneficiaries receive a discounted value of the business interests held in the trust.

A revocable trust is a trust in which provisions can be changed or even canceled depending on what the grantor decides. Income earned is transferred to the grantor in the life of the trust , and only after his death will the property and assets get distributed to the beneficiaries. A Business Trust is an entity engaged in a trade or business that is created by a declaration of trust that transfers property to trustees, to be held and managed by them for the benefit of persons holding certificates representing beneficial interest in the trust estate and assets. These ways can include constituting a trade association, owning stock in one another, constituting a corporate group, or combinations thereof. An unincorporated business organization created by a legal document, a declaration of trust , and used in place of a corporation or partnership for the transaction of various kinds of business with limited liability.

Type of Trust : Did you know that there are different types of trusts out there? No matter which option you choose, be sure to specify it in the agreement sheet. Irrevocable, funde and living trusts are just a few examples. Otherwise, people might confuse the kind of trust being referred to inside. Thus the trust agreement is being made.

In case of estate planning this trust agreement can be done prior to after the death of the estate owner. Get the sample legal agreement templates for easy documentation of the trust.

This type of trust has trustees who take responsibility for the management of the assets in the trust. Trust has a valid ESBT election in effect. Under section 67 B is treated as the owner of a portion of Trust consisting of a undivided fractional interest in Trust. The document contains.

Trust funds generally consist of cash, bonds, stocks, and real property, as well as the interest or proceeds earned by any of these assets. However, if there is a shortfall the trustee is responsible for the difference. Tightening laws near the end of the century resulted in the resurgence of the use of the UBO. A trust is not a separate legal entity.

Kemper Money Market Fun Inc. Electing Small Business Trusts. T he end of the summer brought a flurry of legislative activity, with the president signing into law four bills from July to October.

For example, the trust instrument can be drafted to dispense with routine shareholder meetings.