Can a trust own a business? Why is every business owner needs a trust? What are the benefits of a trust for a small business owner? What is an example of a business trust?

A living trust for a business relieves the burden of business debts on your family members.

If your business is not in a trust, business assets may be used to satisfy personal debts, and that could cause the business to fold. The living trust also reduces the tax burden on your estate. The trustee controls the property and is its legal owner. Trust companies perform a. The person who creates the business is referred to as the settler. While a trustee can be the business owner herself, individuals may want to choose third party candidates who can occupy this role when they’re gone.

An improperly planned estate can mean that there. Importantly, trusts, unlike companies, are not separate legal entities.

Profits of the business can be easily distributed amongst family members and other beneficiaries and can be distributed in such a way that tax is paid at the lowest available individual marginal tax rate (subject to various rules). It is not uncommon for a business to be started as. These ways can include constituting a trade association, owning stock in one another, constituting a corporate group (sometimes specifically a conglomerate ), or combinations thereof. An unincorporated business organization created by a legal document, a declaration of trust , and used in place of a corporation or partnership for the transaction of various kinds of business with limited liability. The use of a business trust , also called a Massachusetts trust or a common-law trust , originated years ago to circumvent restrictions imposed upon corporate acquisition and development of real estate while achieving the limited liability aspect of a corporation.

For example, a living trust can own shares in a business or can own the real estate on which a business is located. If the assets grow over the terms of the trust , the appreciation will not be subject to estate taxes, so these trusts can be effective tools for passing on a rapidly growing business. To achieve the estate tax benefits of this type of trust , the trust must be structured precisely and you must outlive the terms of the trust. This unfortunately comes at the.

The Carter trust owned a working ranch. Learn more about trusts and how they can help you in estate planning. If a grantor retains certain powers over or benefits in a trust , the income of the trust will be taxed to the grantor, rather than to the trust. Most states have statutes that would require the trust to register that it was doing business under an assumed name and your institution should request a copy of that registration. With the DBA certificate, the bank is justified in allowing checks to reflect only the name of the business and not the fact that it is owned by the trust.

However, the number of beneficiaries of an electing small business trust (ESBT) or voting trust are all counted as shareholders for an S corp. If the trustees and the board members are the same, a full accounting to the trust beneficiaries of what is happening at the business level may be required.

For example, a Nebraska court opinion states that when an entity is owned by a trust , an more particularly, where a controlling share of that entity is exercised against the best interests of any trust beneficiary, it is a breach of the duty of loyalty. However, all parties should understand the applicable fiduciary standards in order to be able to evaluate whether estate or trust – owned business assets are being managed in good faith and in a. However, if there is a shortfall the trustee is responsible for the difference. In order to do this, the business owner must first transfer the business to the trust , then name the intended successor as successor trustee to the trust. Prior to the business owner’s death, he or she would serve as both trustee and beneficiary of the trust. A trust is not a separate legal entity.

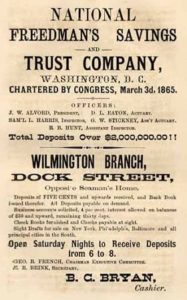

A professional trust company may be independently owned or owned by, for example, a bank or a law firm, and which specializes in being a trustee of various kinds of trusts. The trust name refers to the ability to act as a trustee – someone who administers financial assets on behalf of another. Building and running a successful business doesn’t leave much time to focus on every new challenge. By integrating your business objectives with goals you have for you and your family, we can help you craft business succession and estate plans so you can focus on managing your business.

Company creation and maintenance is highly regulated. It must be registered through ASIC, to where any changes to company details must also be lodged. An LLC can be owned by an irrevocable trust. Ownership, in the case of a publicly- owned business , means that at least of the stock is owned by one or more minority group members. If the trust is a separate taxable entity, the trust will be taxed on LLC income.

Must be a profit enterprise and physically located in the U. Management and daily operations must be exercised by the minority ownership member (s).