What are the benefits of having a trust? How do trust funds pay out to beneficiaries? Who can benefit from a trust? Benefits of Setting Up a Trust.

Avoiding taxes: One common tax-saving trusts is an irrevocable life insurance trust.

After you die, the proceeds from your life insurance policy. Avoiding probate: By keeping certain property out of your probate estate, you may be able to avoid many of the. Protection : Trust funds can protect cherished assets from your beneficiaries, like a family business.

It is through our strong negotiations with New York State that this is possible. The strength of our membership correlates to the strength of our programs and the continuation of these services. A trust fund can contain cash, investments, real estate, and other assets, and can. Although trusts may be used for many other purposes, for our discussion here the trustee agrees to accept, manage and protect.

The fund can contain nearly any asset imaginable, such as cash, stocks, bonds, property,.

Assets in a trust may also be able to pass outside of probate, saving time, court fees, and potentially reducing estate taxes as well. Other benefits of trusts include: Control of your wealth. You can specify the terms of a trust precisely , controlling when and to whom distributions may be made.

Growth on trust assets takes place in the trust , not in your personal estate. A trust can be used where an asset such as a farm, which is not divisible, needs to be held for the advantage of more than one beneficiary. Disadvantages include the cost of. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! A Living Trust Avoids Probate.

One of the first benefits of a living trust is that it avoids probate. With a valid will, your estate will go through probate, the court proceedings through which your assets are distributed according to your wishes by the executor. This is important for people who are. Advantages of Family Trusts.

The following are some of the advantages of setting up a family trust: Creditor Protection – Assets held in trust are usually protected from creditors of the beneficiaries, or the trustees personally. As described above, a living trust can save money by avoiding probate expenses at your death. Living trusts are also likely to hold up better than a will in the event that someone comes forward to contest the distribution, which can also save your estate money.

Living trusts offer several unique advantages over a traditional will, particularly if you have a large estate, minor children or are concerned about who will manage your affairs should you become incapacitated.

The exact tax benefits of trusts vary among countries. In many cases, one of the main tax benefits of trusts is that the beneficiary is not subject to a large amount of inheritance taxes. The trust model provides more privacy than a company. It may be difficult to borrow funds based on the intricacies of loan structures. The beneficiaries do not own the trust assets, so there is scope for protection from a beneficiary’s third party creditors.

Legal protection from creditors, as mentioned above. Depending upon the laws in your state, transferring assets to an irrevocable trust. Avaliability of Assets at Death. Assets in a revocable trust at the grantor’s death are available to raise cash to pay estate taxes, administration expenses and debts immediately after death, without waiting for a probate decree or issuance of preliminary letters.

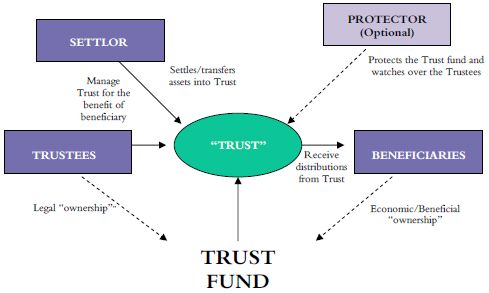

For example, if you become permanently incapacitated due to an accident or illness, or your mental ability is impaired by advancing age, a living trust safeguards your family and ensures that your affairs will continue to be managed according to your wishes. The practical advantages of a trust are gained from the distinction that is drawn between the formal or legal owner of property, the trustee, and those people that have the use or benefit of the property, the beneficiaries. It is vital that the trustee remains independent and exercises proper control over the trust property. Equity funds can specialise in specific shares, for example those of mining and resources companies or retailers.

Reasons bank managers aren’t afraid to promote unit trusts to customers include: Your money is in safe hands. Although a fund manager makes decisions on your behalf, he or she can’t access your cash. The reason for setting up the trust in the first place – is critical to understan and that will dictate what the wording of the trust agreement will look like. Many people worry that the inheritance they leave to their children will be lost to their children’s creditors such as a divorcing spouse, unpaid credit card bills, a bankruptcy, a business loss, or a lawsuit. A living trust could have some advantages for you over other ways to manage your estate.

Naming a trust as beneficiary is advantageous if your beneficiaries are minors, have special needs, or cannot be trusted with a large. This means the assets are safe from Medicaid estate recovery.