What is the meaning of beneficiary account? What do you need to know about being a beneficiary? Should you add beneficiaries to your accounts?

A beneficiary account is a Demat account in the name of an Individual (single or jointly ). Such an account could also be in the name of a Corporate, a partnership firm, a society and a trust. Many banks offer payable-on-death (POD) accounts as part of their standard offerings.

A POD account instructs the bank to pass on a client’s assets to the beneficiary , which means money in a POD account is. Upon the qualified plan holder’s passing, a. After your death, the account beneficiary can immediately claim ownership of the account. Before you set up your account, let’s examine the bank account beneficiary rules more closely. Other articles from estate.

Federal banking regulations allow a bank account holder to designate another person to receive the balance of the account in the event of his death. The person designated to receive the funds after the account holder’s death is called a beneficiary. Inherited from spouse.

So if your will states that your spouse is your IRA beneficiary, but the IRA itself designates your children as your beneficiaries, your children will inherit your IRA.

Meaning you are still able to utilize the stretch provision. The account number to which the funds have to be credited is called the beneficiary account number. And further the context of usage of beneficiary may vary depending on the type of banking transaction.

Beneficiary in banking terms is the recipient of the funds. Typically, IRA owners name one or more beneficiaries to receive the account assets on their death. If a deceased account owner did not name a beneficiary , TD Ameritrade follows a line of succession to find one. The designated beneficiary , however, can be changed by the account holder at any time. Parents may designate their children as beneficiaries of their bank account.

In some cases, an account holder designates a primary bank account beneficiary and a secondary beneficiary. If they are dead or if they die with you, your assets would instead go to any secondary beneficiaries you have designated. These secondary beneficiaries are often referred to as contingent beneficiaries on account forms. Insurance policies and retirement plans have designated beneficiaries and the proceeds go directly to these individuals without the necessity of probate when you die.

If you have a retirement account , such as an IRA or 401(k), then you should always name a beneficiary. Every broker has beneficiary forms that are. The non-spouse beneficiary was then only required to take small distributions each year from the account called a RMD (“required minimum distribution”) but was allowed to keep the retirement account intact and continuing to accumulate tax deferred over their lifetime. After we have the death certificate and the deceased’s Social Security or account number, we can identify the account beneficiaries. If the account owner didn’t name any beneficiaries , the account becomes the property of the estate.

Death After Retirement – What happens to the rest of your retirement account if you die after retiring?

On a nonretirement account , designating a beneficiary or beneficiaries establishes a transfer on death (TOD) registration for the account. For an individual account , a TOD registration generally allows ownership of the account to be transferred to the designated beneficiary upon your death. If there is no designated beneficiary form and the account goes to the estate, the beneficiary will be stuck with the five-year rule for distributions from the account.

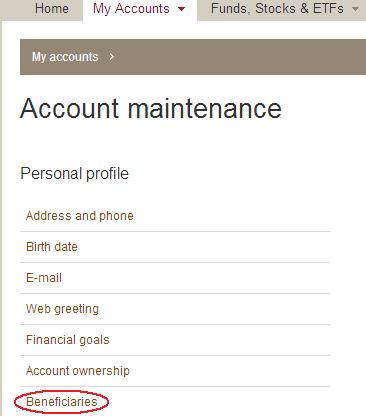

The simplicity of the form. Naming a beneficiary is an easy thing to skip over when opening an account , but this small step can save a huge headache – and potentially a lot of money – later on. The POD is also known as a transfer-on-death, or TO account , also called a Totten trust.

Your bank or credit union will add the beneficiary to your account free of charge. Learn two approaches to investing the money in your beneficiary participant account. You can change the beneficiary as often as you like.

When your beneficiary participant account is first establishe the entire balance is invested in the Lifecycle (L) Fund targeted most closely to the year you turn (or the L Income Fund if you’re age or older). The executor of the estate is the person in charge of distributing the assets in the estate. The executor is often, but not always, also a beneficiary. The beneficiaries of the estate are the people entitled to receive those assets. If, however, you opened a second account with a POD beneficiary , that account would be separately insured up to $25000—so in effect, your coverage is doubled.

To check on FDIC coverage for your accounts , go to the FDIC’s easy-to-use “Electronic Deposit Insurance Estimator.