Early access on compassionate grounds. There are very limited circumstances when you can access your superannuation early. You may be allowed to withdraw some of your super on compassionate grounds for unpaid expenses, where you have no other means of paying for the expense. We are responsible for assessing applications for the compassionate release of super on specific compassionate grounds, including: 1. See full list on ato. We can consider applications to meet costs of medical treatment not readily available through the public health system.

The regulations require applicants to give us written statements from two registered medical practitioners (one must be a specialist) certifying the medical treatment is necessary to: 1. Medical treatment includes dental treatment. In these cases, certification must be provided by either: 1. GP) and a dental practitioner or dental specialist. We can consider compassionate release of super to meet costs associated with transport to access medical treatment, such as: 1. In addition to meeting the certification requirements for medical treatment, a treating registered medical practitioner and a registered medical specialist must also certify: 1. If the patient requires medica. What is compassionate release of superannuation? Can I receive a Super?

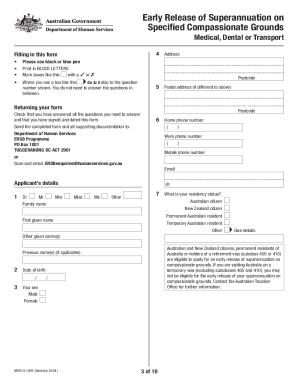

Your details Name Family name First given name Other given names Title: Mr Mrs Miss Ms Other Day Month Year Day Month Year Date of. The applicant can be the patient or someone applying on behalf of a patient. Australia or New Zealand. Detailed information on how to apply is available on their website at ato. You can only submit one application for COVID-early release of super this financial year.

Instructions for individuals. When to complete this form. Generally, you cannot access your superannuation before you reach your preservation age. Some super funds are able to check if you meet the income support criteria. They can use our Centrelink Confirmation eServices.

It means you don’t need to contact us for the information. The amount of super that you can pay on compassionate grounds is limited to what is reasonably. Withdrawing your super and paying tax. Compassionate grounds.

Superannuation ( super ) is money you put aside during your working life for you to use in retirement. It’s important you provide all information and supporting evidence we ask for. If you don’t, we may not be able to consider your application. The ATO will assess your eligibility for release on compassionate grounds when you apply. To see the eligibility criteria, read the ‘Accessing your super’ section of our website at unisuper.

SECTION — Member details Please use BLACK or BLUE BALLPOINT PEN and print in CAPITAL LETTERS. You must provide a certified copy of one acceptable photographic ID document or two non-photographic ID documents. The approved amount can then be released early by your super fund to cover your eligible unpaid expenses. High call volumes may result in long wait times.

Before calling us, visit COVID-1 Tax time essentials, or find to our Top call centre questions. The ATO should send a message to your myGov inbox with the outcome of your request for early release. Generally, super you access as a DASP will be taxed at if you’ve been paid any of that super while on a subclass 4or 4visa or an associated bridging visa.