Registration obligations for businesses. Not everyone is entitled to an ABN , so the registration process will ask specific questions to determine your entitlement to an ABN. If you apply for an ABN and you’re not entitled to one, your application may be refused. The reason for refusal will be explained to you by the Australian Taxation Office. As not everyone is entitled to an ABN , you will be asked a series of questions when applying for one to determine your entitlement.

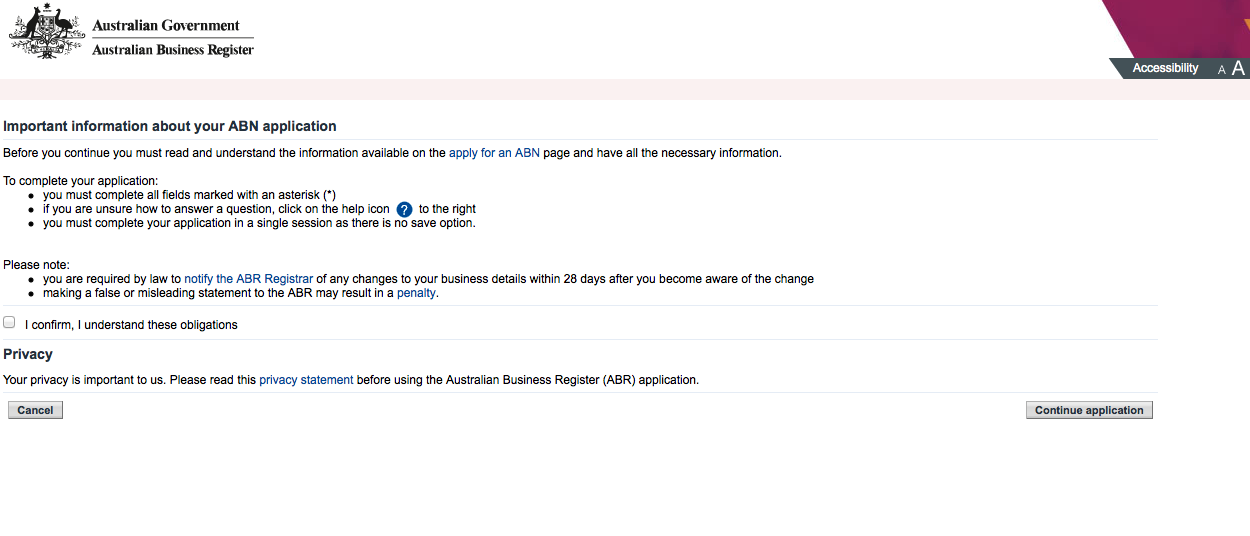

If you are experiencing an issue accessing the ABN application please use this alternative link. The ABN is a unique digit number that identifies your business or organisation to the government and community. Watch this video to find out more about ABNs. When you apply for your Australian Business Number ( ABN ) you will be asked to identify your organisation’s entity and organisation type.

High call volumes may result in long wait times. Before calling us, visit COVID-, Tax time essentials , or find to our Top call centre questions. What is the ABN number? How do you register a business name in Australia? Ensure your client is entitled to an ABN prior to applying.

Use the relevant application process for: Foreign passport holders, permanent migrants and temporary visitors – you need to already be living in Australia and will need a valid passport or travel document (visa). Australian residents – for people who were born in Australia or have Australian citizenship. Your ABN direct to your inbox in just minutes. We start more than 100Australian businesses every year. ABN (Australian Business Number): of companies receive their ABN within minutes during business hours.

Cancel an ABN External Link. Apply for an ABN External Link. Set up myGovID and Relationship Authorisation Manager (RAM) No. It will take advised business days to be activated. You can use the same ABN for all the business activities carried on by your husband.

Non-residents have certain requirements for providing identity evidence for Australian business number ( ABN ) registrations. There are other options available to cancel your ABN. You must be recorded as authorised to update ABN details for your business.

You’ll also need to prove your identity. Application for ABN registration for individuals (sole traders) The fastest way to get an ABN is to apply online at abr. Only use this paper form where you are unable to apply online. Your business will use its unique number to identify itself when dealing with the government, other businesses and the public. Are you starting a business?

To help you get starte see our Starting a business guide. The ATO review ABN applications to ensure only genuine businesses get, and keep, an ABN. You may need to provide the ATO with evidence that you are entitled to an ABN. Find out why you need one and how to apply for one. An unique number for every business An Australian Business Number is an 11-digit number unique to each business.

Thinking about applying for an Australian Business Number? Check if you’re entitled at abr. Download transcript: ABNs and your obligations_transcript_50sec. An ABN is used in conjunction with your TFN, or tax file number, when dealing with the ATO and should be listed on any invoices or receipts you provide clients or customers.

As such, registering for and acquiring an ABN must take place before your new business begins trading. Ask questions, share your knowledge and discuss your experiences with us and our Community.