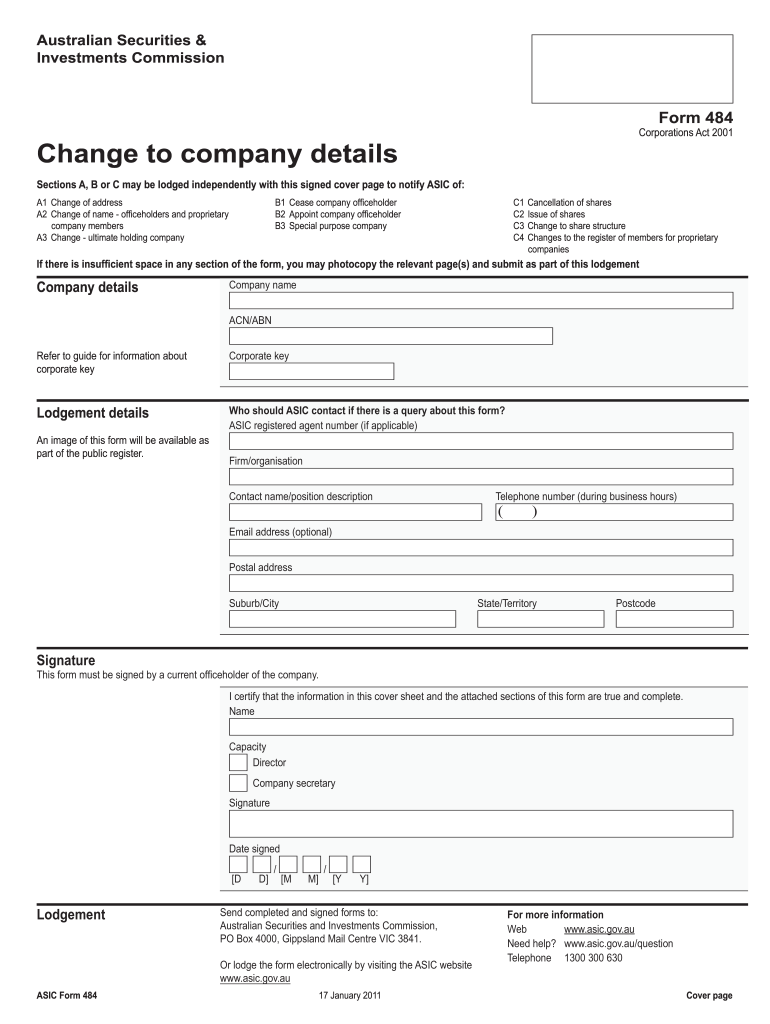

Once logged in, select ‘Start new form ‘ in the left hand menu. Select change to be notified. Shares are transferred ( e.g. sold) from one member to another or new member. A Form 4is required to notify ASIC of this change within days of the transfer.

The paper Form 4is no longer available. You need to register to use our online services before you can make any changes. To make changes to company details: 1. See full list on asic.

Appoint and cease company officeholders 3. Add or remove ultimate holding company 4. Change company addresses 2. Transferring shares 6. Otherwise, late fees apply: 1. Company financial year 4. Officeholder details 5. Please ensure you register for online access and make all changes in the time allowed. Use our online services 2. Support for company officeholders lodging transactions online 3. You can change shareholder details online, including their name, address and beneficial status. The register must contain the following information about each member: 1. Beneficially held means that the owner of the shares gets the direct benefit from the shares. For example, benefits could include dividend payments. Shares held by a person as trustee, nominee or on account of another person are non-beneficially held (i.e. the member holds the share for the benefit of someone else).

If the holder of the shares is a trustee or executor, the shares should show as not being beneficially held. This requirement does not apply to a listed company. This form asks for information about the: 1. A company can issue different classes of shares. The rights and restrictions attached to shares in a class distinguish it from other classes. Redeemable preference shares.

The rights attached to an issue of preference shares must be approved by a special resolution, or be set out in the company’s constitution. Preference shares are shares that give holders some right or preference. This protects the interests of existing members by ensuring that they agree to the rights of the preference shares. If shares are issued for non-cash consideration under a written contract, all companies must tell us within days after the issue by a: 1. Certification of compliance with stamp duty law (Form 207Z). Proprietary companies must also tell us if: 1. A public company only needs to tell us after the annual statement is issued.

Benefits could include dividend payments or voting rights. Ordinary Fully Paid Shares , Option and applicable expiry date, etc. Forms Invalid search entry: Special characters are not allowed. These shares were then transferred to Simon Duran where he paid a total of $1for the total 1units of ordinary shares. In CAS 36 the amount paid per share can be recorded as $1.

On ASIC database, when the same shares were transferre the shares must have the same cost. Thus, on Form 484C, amount paid for shares must be shown as $per share to match ASIC database. However, it is saying under Section C completion guide of the form that this section should not be filled in for a share transfer. Solution For EDGE electronic lodgement purposes, there is a requirement that certain sections of ASIC forms have to be filled in although this is not necessary for manual lodgement. An online portal has replaced form 484.

Therefore, you can make these changes in a relatively straightforward way. However, you must still correctly report the changes within ASIC’s guideline of days. If you fail to do so, you might face some fines. These include having to pay: $if you are up to one.

The current form to use to notify the transfer is Form 484. It must be submitted online. Confirmation of the Deceased Holder’s Identity form (if the deceased shareholder’s name on the register does not exactly match the death certificate, will or probate) e. Original share certificate(s). Make use of the Sign Tool to create and add your electronic signature to certify the Asic form 484.

Press Done after you finish the form. Now you may print, save, or share the document. Reductions in share capital must be notified to ASIC within days after the passing of the resolution to reduce share capital.

These companies are not required to provide any details about share structure or members.