What is APRA regulated funds? List of superannuation funds – this is the Super Fund Lookup service which provides publicly available information about superannuation funds that have an Australian Business Number. It includes funds regulated by the Australian Taxation Office and APRA. Mysuper or eligible rollover fund authorisation.

Have a look through our Frequently Asked Questions or try searching the APRA website. Subscribe for updates. Super funds regulated by the Australian Prudential Regulation Authority (APRA) have important reporting and administrative obligations to us and their members. Fund Profile This Reporting Standard sets out the requirements for the provision of information to APRA relating to the membership profile and insurance arrangements in the business operations of an RSE licensee that is trustee of a small APRA fund or a single member approved deposit fund.

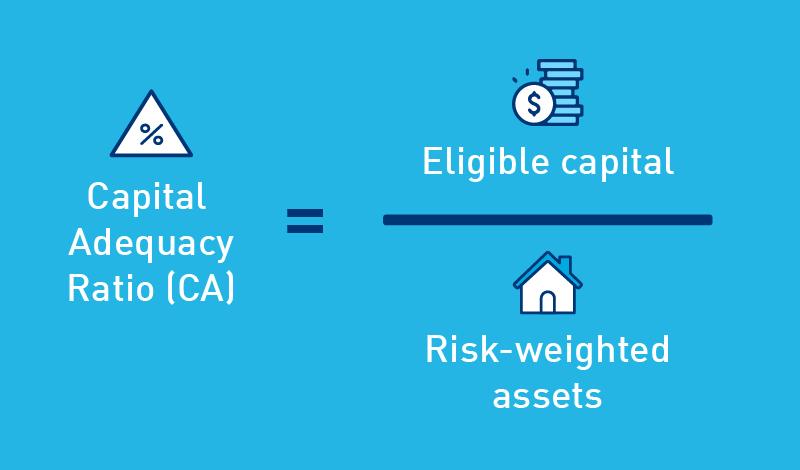

The Foundation Board of Trustees is comprised of leaders in our industry who have served or currently serve on the Apra Board of Directors. Under the legislation that APRA administers, APRA is tasked with protecting the interests of depositors , policyholders and superannuation fund members. APRA promotes financial system stability by working closely with the Australian Treasury, the Reserve Bank of Australia, and the Australian Securities and Investments Commission. The aim of this flexibility was to allow banks to use capital buffers, if neede to support the ongoing supply of credit to the Australian economy. This applies to all ADIs, Life, General and Private Health insurers, including foreign subsidiaries.

The Annual Fund-level Superannuation Statistics report contains detailed profile and structure, financial performance and financial position, conditions of release, fees and membership information. Learn more about the keynote presentation in the latest episode of Beyond Prospecting: The Apra Podcast now. Discover Important, Trending Topics at Apra Talks: The Friendly Debates Join us at The Prospect Development Virtual Experience for Apra Talks: part conversation, part debate, all fun! Harris Computer Systems.

APRA recommends directors spend no more than years on a super fund boar but Ian Armstrong spent years on REI Super and Neville Pozzi sat on the board for years, while Paul Conway has. An, Australian Prudential Regulation Authority ( APRA )-regulated fund is another type of superannuation fund. Most Australian taxpayers have their superannuation invested in APRA -regulated funds.

These include industry super funds, corporate super funds and company super funds. In total, APRA considered funds – or more than one-fifth of all default funds – to be underperformers. On the investments front, Rice Warner said most APRA -regulated funds have a single diversified (balanced) fund shaped around MySuper.

Like an SMSF, SAFs are also restricted to a maximum of four members. These different types of funds have different regulators. As their name implies, small APRA funds are regulated by the Australian Prudential Regulation Authority ( APRA ). If a fund receives the election after the ILBA has been reported and paid to us, the fund should advise the member their account has been appropriately sent to us. Among all funds that made payments, 1(per cent) completed more than per cent of payments within the five business days guideline indicated by APRA. With limited exceptions ( per cent), payments to members have been completed within nine or fewer business days from receipt of applications by funds from the ATO.

We don’t use our music grants to fund individual songwriters or composers. Instea we take a holistic approach to ensure we can support the greatest number of members and our community in general. The purpose of APRA is to provide a common base of knowledge, standards of care, and professionalism within the reserve study provider industry.

Small APRA Funds – the overlooked option? As we mention elsewhere, self managed superannuation funds (SMSF) have proven extraordinarily popular in Australia – in our view, perhaps too popular on occasion. The intention for the fund is, very simply, to provide real financial support so that music creators can continue to make new music,” said Morris. The initial funding pool of $3000 comes from the APRA Board’s decision to reduce their Director’s fees and.

Become an APRA Member Today! To help you better understand what super funds are available, on this page you can find a list of all super funds that are regulated by APRA. This is essentially every fund except for SMSFs and small APRA funds. Most APRA funds have a single diversified (balanced) fund shaped around MySuper. APRA funds must be able to send and receive electronic messages and payments using the SuperStream standard High call volumes may result in long wait times.

Before calling us, visit COVID-, Tax time essentials , or find to our Top call centre questions. A small APRA fund (SAF) is a self-managed super fund with a professional trustee. A SAF offers the freedom and flexibility of a self-managed super fund but without the associated trustee responsibilities and risk of compliance breaches. Analysing total fees, investment fees and the financial sustainability of the funds, APRA has revealed which default funds are the worst in the country.

While professional super funds are regulated by the Australian Prudential Regulation Authority (APRA), SMSFs are regulated by the Australian Tax Office (ATO). This means they don’t benefit from the same regulatory oversight. How does this impact you?

Art Music Fund recipient Lisa Cheney helps.