Is a LLC a limited company? Can a company escape the liability to a corporation? What is the difference between a company limited and a guarantee? Is usually formed to carry out non-profit making activities such as promoting arts , etc.

Is one which has members instead of shareholders. These members agree to pay a fixed sum in case the company is wound up. Therefore, this guide is prepared for directors and other officers of companies limited by guarantee (CLG), which are also NPOs. CLG-NPOs may be at risk of being abused for money laundering or terrorism financing or other forms of terrorist support by virtue of charitable characteristics or activities.

A CLG is used to carry out non-profit making activities like charity work. Since CLGs are registered with the Accounting and Regulatory Authority of Singapore (ACRA) and governed by the Companies Act, it is usually set up by non-profit organisations requiring a corporate status. The registered office of the company is situated in the Republic of Singapore. The liability of the members is limited.

Each member of the company undertakes to contribute to the. Non-profit organisations in Singapore: 1. See full list on guidemesingapore. Although it is not mandatory to register your NPO in Singapore, it will be difficult to engage in any meaningful and sustainable activities unless you are a registered entity. It is important for you to consider that only legal entities can enter into contractual agreements (e.g. leases, purchasing contracts). Without a registered entity, it will be almost impossible for you to raise funds from non-members.

Working with an established set of legally binding rules provides clarity, to those within the organisation and to stakeholders outside the organisation. A registered entity is a criteria which most donors use to evaluate requests fo. You can choose one of the following three types for registration of your non-profit organisation in Singapore: 1. In order to decide on the specific type of entity you should choose to register your non-profit group in Singapore, you should review the details of each type of entity as provided below and then decide on the non-profit entity type that’s most suitable for your situation. Forming a company limited by guarantee for setting up a non-profit organisation has the distinct advantages of incorporating a separate legal entity with limited liability for its members.

Out of the various choices available, this form of entity is the most advanced and the most desirable type of structure. Companies limited by guarantee are typically engaged in non-trading charitable, religious, scientific, or artistic activities. Society is suitable for membership or volunteer based groups, especially smaller groups with strong community links and not heavily dependant on donations and external funding.

A charitable trust is a type of purpose trust in that it promotes a purpose and does not primarily benefit specific individuals. After the non-profit entity (society, company limited by guarantee, trust) has been registered and obtained a legal status in Singapore, it is possible to secure charitable status. When reviewing the application for charity status, the Commissioner of Charities will look at whether the objectives of the organisation are acceptable as charitable.

Being a charity is a matter of status, not of organisational structure. Charity status brings certain benefits such as 1. All registered charities in Singapore enjoy automatic tax exemption. It gives a standing and credibility to the organisation. Many grant-giving trusts and foundations can only give funding to recognised charities.

Charity” is a very emotive word and can be very persuasive in encouraging the general public to donate. Charitable status is beneficial for fund raising. An approved IPC is an NPO with a charity status whose activities are beneficial to the community in Singapore as a whole, and not confined to sectional interests or group of persons based on race, cree belief or religion.

IPC are approved by the Commissioner of Charities to receive tax-deductible donations (i.e. donors are given tax deduction for donations made to these organisations). Most IPCs are charities, and the rest are sports associations. The processing time on applying for IPC status takes about two months. If you are interested in setting up a non-profit entity in Singapore, you should seek the services of a professional services firm that can assist you with the registration as well as on-going statutory compliance matters of the entity.

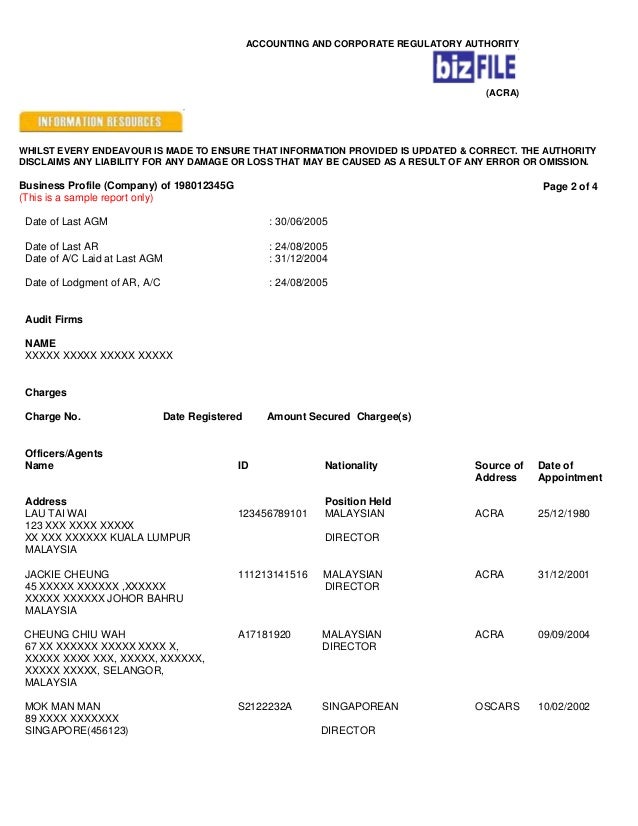

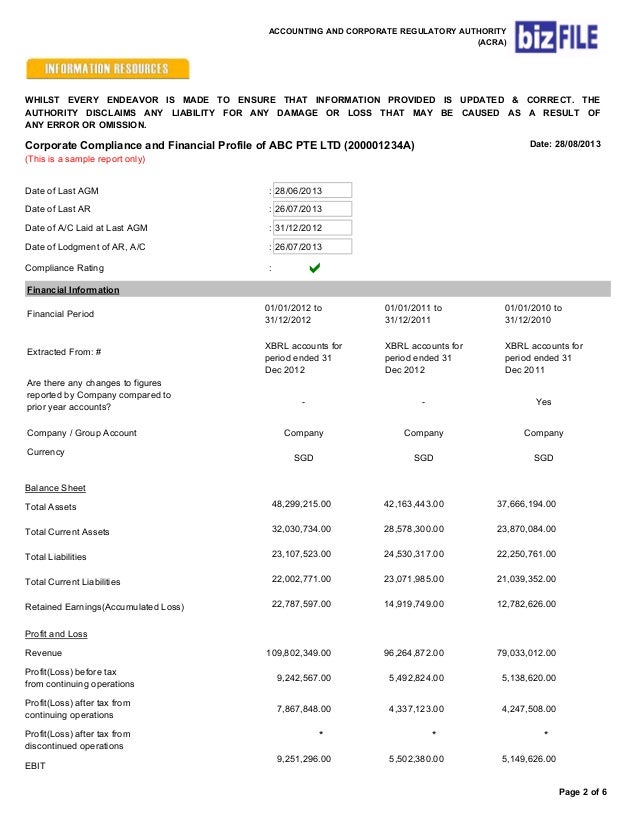

Once you have registered your NPO in Singapore, the challenge ahead is fundraising, publicity and volunteers – the key determinants to the successful running of your NPO. To find out more about these facets, refer to Setting up a non-profit entity in Singapore – Part 2. A company limited by guarantee is just a limited company , but with the obvious difference to the usual company entity of there being no share capital. The company’s members are guarantors rather than shareholders. This form of company entity is often used by charities, but not all companies limited by guarantee are charitable in nature. The Accounting and Corporate Regulatory Authority ( ACRA ) is the national regulator of business entities, public accountants and corporate service providers in Singapore.

This guaranteed amount is usually nominal. Most CLGs set the amount per member to $1. It is a separate legal entity, meaning there is a legal veil separating the owners from the entity. Limited Liability Company. Recreational (sports and bowling clubs), cultural and charitable organisations commonly use this type of corporate structure.

A company is a small company limited by guarantee in a particular financial year if : it is a company limited by guarantee for the whole of the financial year. Staying Compliant with ACRA. All Singapore private limited Company is subject to staying compliant with Accounting and Corporate Regulatory Authority (“ ACRA ”).

Annual filings are mandatory for both active and dormant Singapore companies. Failing to regularly meet ACRA ongoing compliance requirements in a timely manner can have consequences. You must provide a registered office address during your application to incorporate a company.

Registered Office Address.