What does due diligence in acquisitions include? What should I review in due diligence? When buying a business checklist? What is the true cost of due diligence? Some questions may need to be added for an industry-specific acquisition, while far fewer will be needed for an asset acquisition.

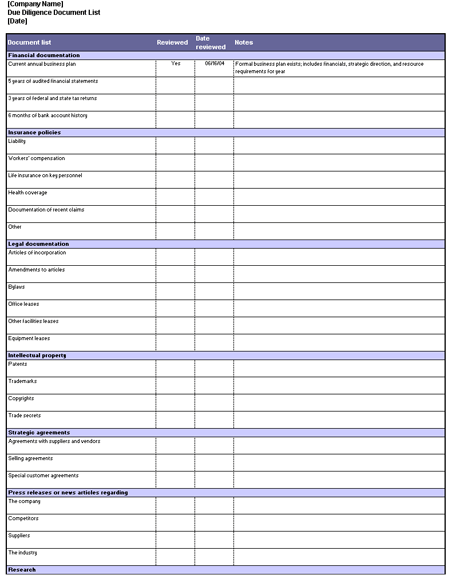

The first step to a due diligence checklist is getting an overall understanding of the target company. The following checkpoints are included for this purpose – 1. Company registration documents, including the memorandum of association and other articles 2. Size of the company, which includes its authorized capital, market cap, number of employees, etc. ITR documents for the last five years 5. Stock structure of the co.

See full list on efinancemanagement. We cannot stress enough on the importance of revenue and customers, which are driving factors for future profitability and growth. It is important for the buyer to understand the target company’s USP and sales model before making the buying decision.

The checklist includes – 1. Does the sale come from a few customers buying in bulk or many customers buying in small quanti. The products and services that a company offers form an integral part of the company. Therefore it is very important to understand each of the offerings. Following part of the due diligence checklist can be really helpful for this – 1. Registration and licenses of each product and its related IPR.

Summary and cost of after-sales service provided by the compa. A material contract is an agreement under which any other company or company’s own subsidiary is bound to supply the raw material to the said company. Following related matters are reviewed in the due diligence checklist – 1. Raw Material and other components supply contracts.

Agreements of partnership, joint venture, subsidiary, etc. One of the most important aspects of an MA transaction is to study the financials of the target company. The financial health of the company is a major factor that determines the future success or failure of the merger deal.

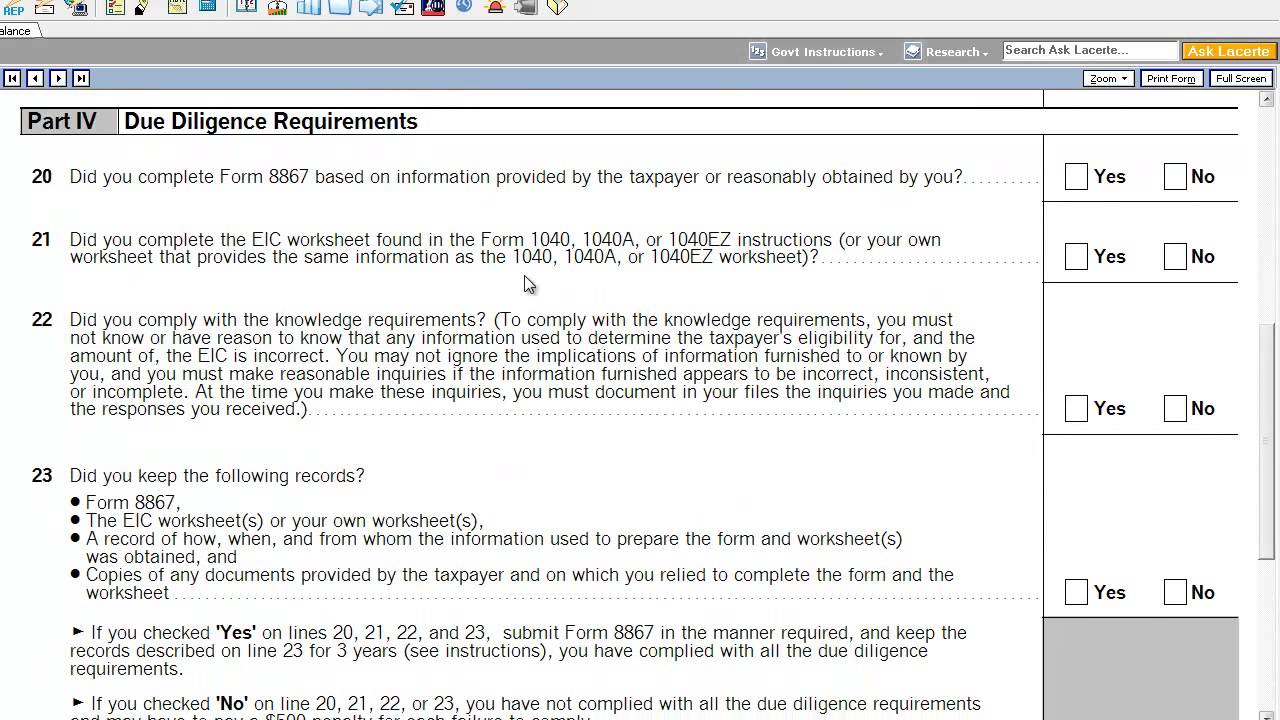

Checklist for the same includes – 1. This is because unhealthy habits towards taxation can give rise to unexpected future liabilities, litigations, and unnecessary troubles. Checking the historical financial per. One must ask the following questions regarding the target company’s taxes – 1. Copy of miscellaneous tax filings of th. Insurance on intellectual property rights 3. Employees insurance 4. Directors and officers liability insurance 5. Workers compensation insurance 6. General liability insurance 7. Following documents must be reviewed as a part of due diligence- 1. For Physical Assets – 1. All the lease and rent documents and agreements.

Scrutiny of antitrust and regulatory issues has increased in recent years. The buyer must undertake the following analysis in order to understand these issues – 1. Analyzing the scope of antitrust issues, for example, issues such as – price cap on target company’s products in a certain region, illegal monopoly, illegal collusion, etc. They must look into – 1. Copies of all licenses, which includes Federal, State, and Local licenses, permits and consent forms.

Due diligence checklist for litigations include – 1. Documents related to past regulatory issues related to license and permits. A list of pending litigation. Claims against the company. Pending government proceedings. Past settlements and its resulting pending liabilities 5. History of litigations 6. Intellectual property rights are one of the most important aspects of an MA deal.

A checklist for the intellectual property includes – 1. Information technology is one of the most important factors that affect businesses in the recent scenario. Level of customization of each software and the period before it gets obsolete or requires an update. Current system usage and interface 5. List of domestic and international patents, tra. Software and data back-up systems.

Outsourcing has now become a necessity for all the organization. Because of the effects of globalization, outsourcing has become easier and cheaper. During due diligence, the buyer must look into the following aspects of outsourced contracts – 1. It becomes difficult to retain employees after a merger or an acquisition.

In order to get the mix perfectly one must include the following questions during due diligence checklist – 1. Make and review a list of employees, their current positions, current salaries, etc. A report of the total expense incurred in maintaining the current workforce. A)Corporate Documents of the Company and Subsidiaries (1) Articles of Incorporation and all amendments thereto. Whether you are the buyer or seller, it is important to know exactly what information will need to be investigated before the deal can be finalized. A due diligence checklist incorporates all necessary information a company must acquire from their target before moving forward with a deal.

Review contributions made towards emp. DealRoom created a mergers and acquisitions due diligence checklist that enables to track the diligence progress and secure important documents. The due diligence checklist includes over items that range from financial to legal to operations items that should be verified before completing the transactions. Any letters of intent, contracts, and closing transcripts from any mergers, acquisitions , or divestitures within the last five years. This list does not cover everything on all property, but is a useful tool and a great place to start when considering purchasing real property.

The operational and financial information that the seller provides to the buyer ensures that they overlook no details (such as litigation risks and liabilities) and that the. This is an important stop on the merger- acquisition checklist for both sides. Acquirer: You wouldn’t buy a car before a test drive, right? The same goes for acquiring a company. Identify the overall objectives of the buyer and seller.

Obtain approval from seller for lines of communication with seller’s staff and for conducting discussions with employees and third parties. Understand the financial needs of buyer and seller. Title Commitment (a) Exception documents (b) Amount of insurance (c) Endorsement list 8.