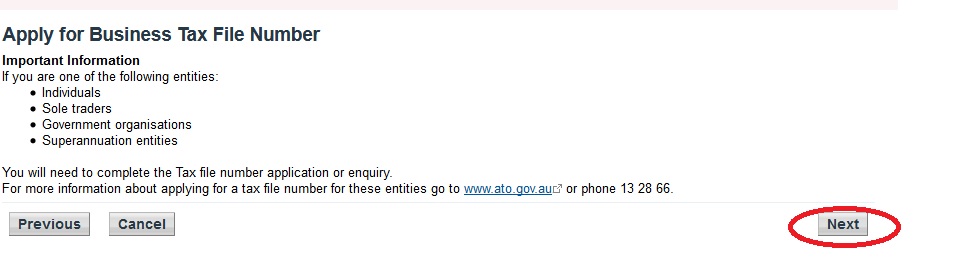

How to apply for a TFN? Can sole traders apply for a TFN? What does TFN stand for in tax? Companies, trusts, partnerships, deceased estates and many other organisations can apply for a tax file number ( TFN ) online. Most businesses or organisations can apply for a TFN while completing their ABN application.

You can apply for a TFN for most businesses or organisations while completing their ABN application. You do not need to register them for a TFN in a separate process. When you apply for a TFN at the same time you apply for an ABN, your client will be automatically registered with a business TFN when their ABN application is processed.

The Australian Business Register will soon start cancelling the Australian business number (ABN) of inactive partnerships. An Australian Business Number is an 11-digit number unique to each business. It’s a legal requirement for anyone who wants to start an enterprise in Australia or who wants to register for GST (Goods and Services Tax). Even if your business isn’t going to register for GST, you still need an ABN. ABN stands for Australian Business Number, and is essential to start a business.

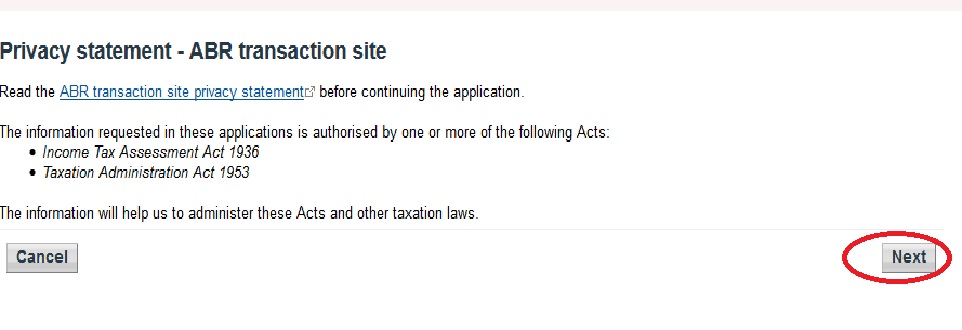

Read the ABR transaction site privacy statement before continuing the application. Note: We are currently experiencing an issue redirecting some newer devices to the online ABN application and are investigating a fix. If you are experiencing an issue accessing the ABN application please use this alternative link. Use myGovID and Relationship Authorisation Manager (RAM) for secure, simple and flexible access to ABR services.

Update your ABN details. Tax Professional Services. Store Podcasts. Earnings Reports for the Week of Feb. You can use this checklist to help you apply online at the Australian Business Register website for: an ABN — which is your Australian Business Number.

See route maps and schedules for flights to and from Tenerife and airport reviews. This is a legal requirement for anyone starting a business in Australia or registering for Goods and Service Taxes. A tax file number ( TFN ) is free and identifies you for tax and superannuation purposes.

You keep the same TFN even if you change your name, change jobs, move interstate or go overseas. If your details change, you need to let us know. ABN Lookup is the public view of the Australian Business Register ( ABR ). It provides access to publicly available information supplied by businesses when they register for an Australian Business Number (ABN). Companies and other organisations can apply for a tax file number ( TFN ) online at abr.

TFN application for companies and other organisations. If you: only need a tax file number ( TFN ), select. You will receive these numbers along with a confirmation of ABN registration via postal mail within 3-working days.

This number is given to all employers when you start working and your employer will then deduct tax from your income under the PAYG (Pay As You Go) system. An ABN is used in conjunction with your TFN , or tax file number, when dealing with the ATO and should be listed on any invoices or receipts you provide clients or customers. As such, registering for and acquiring an ABN must take place before your new business begins trading. JavaScript is not currently enabled in this browser.

A TFN is a unique number we issue to individuals. It is an important part of your tax and superannuation records, as well as your identity. It is also an important part of locating and keeping track of your superannuation savings.