What are the legal obligations of a sole trader? Why to work as a sole trader? What is the difference between self-employed and sole trader? Should you register as a sole trader or a limited company?

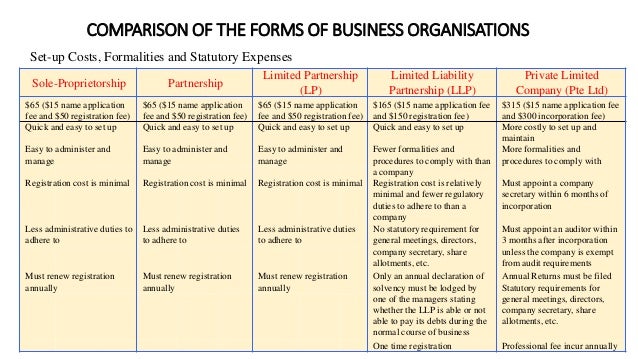

Sole Trader vs Partnership. See full list on accountlearning. A sole proprietorship is an unincorporated entity that does not exist apart from its sole owner. A partnership is two or more people agreeing to operate a business for profit.

The benefit of owning a sole trading company is that the sole trader has the right to make all decisions regarding the business. This is the simplest structure. Financial responsibility however is in your hands and you will have yearly tax returns to contend with. You will also have legal responsibility for your business (which can leave you exposed to much greater risk than other structures), so a comprehensive insurance policy is a must.

A limited liability partnership (LLP) offers more protection to individual partners as it limits liability to what each partner has invested in the business. You will however have to register with Companies House and put certain information on the public record if taking this option, much like a limited company. For example, providing yourself with a car for business travel is likely to be far more tax efficient this way than through a limited company structure. (more…)