Australia Income Tax Treaty exempts superannuation from U. We can provide a Tax Opinion to secure the legal exemption. For a non-complying fund the rate is the highest marginal tax rate. Our expert team can assist if you’re just starting out, or you have an established fund.

Retail funds will deduct the contributions tax immediately and leave you with cents in the dollar. More importantly after commencing a Pension, the capital gain on selling the Property is also tax free!

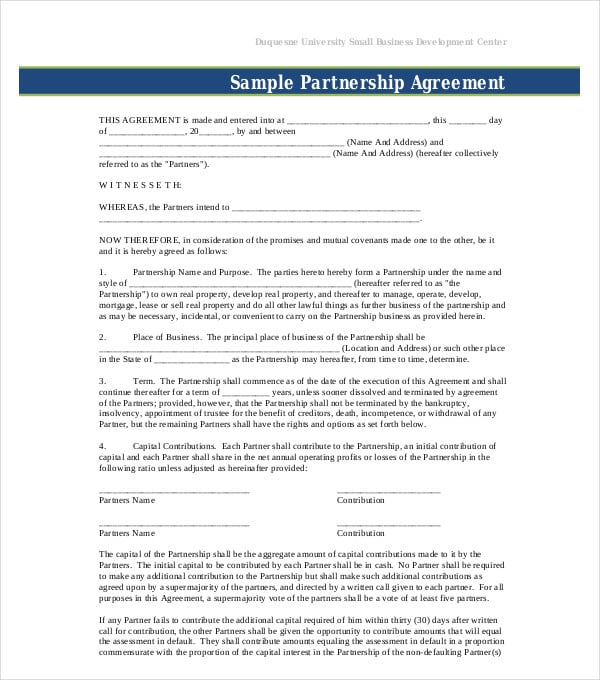

It has sections, each described below. Owe back tax $10K-$200K? See if you Qualify for IRS Fresh Start (Request Online). When it comes to your fun don’t use just any accountant.

In this situation, fund expenses must be split between these two types of income, and only the amount apportioned to taxable income is tax deductible. Tax effects during the accumulation phase. However, it’s important to understand what your fund can and can’t claim as investment property tax deductions. Through either strategic investment planning (such as maximising franking credits) or internal structuring, tax can be significantly reduced (and in some cases, totally eliminated with refunds paid from the ATO), particularly for those in retirement.