You do NOT need a tourist visa to travel to this country. Exit Requirements: None. Visa requests cannot be processed without your original passport.

Exceptions include German citizens (up to months), Bulgarian nationals (months), and Greek nationals (month). Do US citizens need a visa to visit Africa?

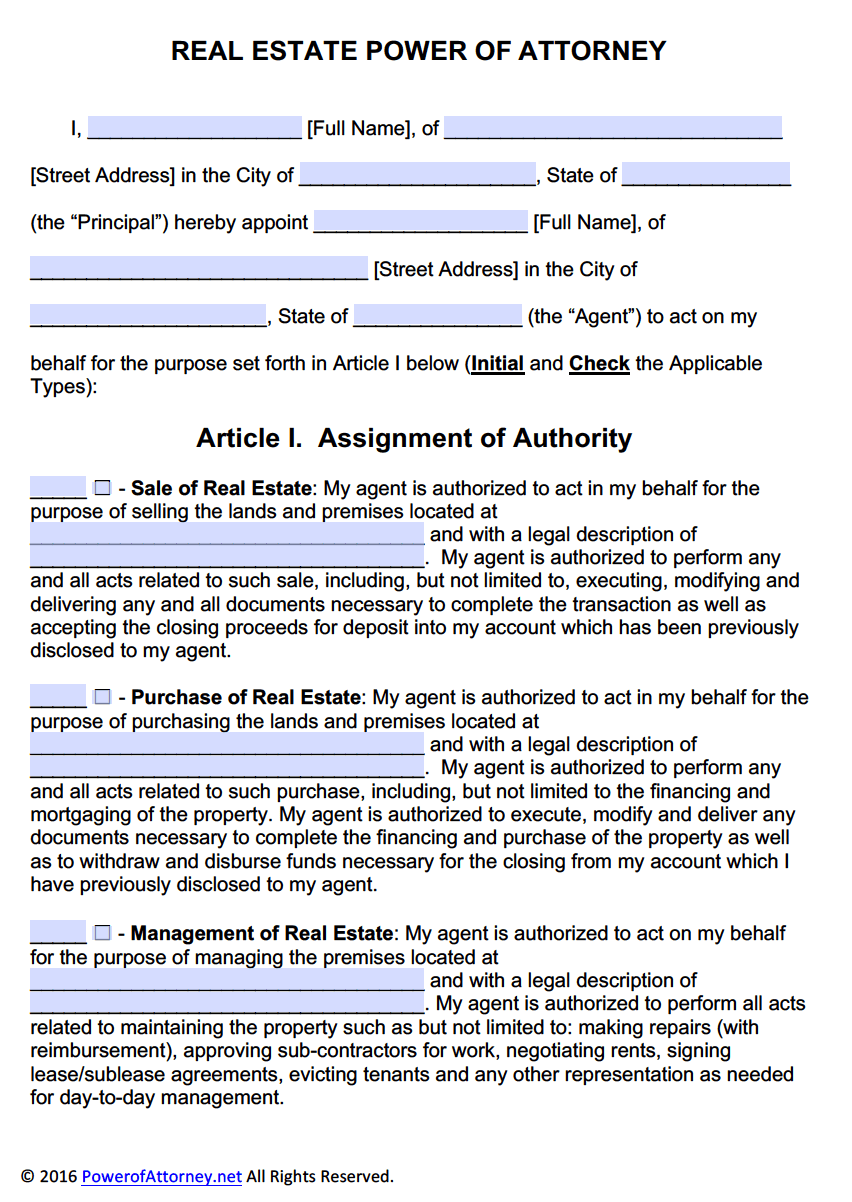

V-and V-status is limited to persons who have not yet attained their 21st birthday. Posts may not issue a T-visa. The machine readable visa (MRV) fee of 1U.

This rule does not apply if you are vulnerable and current circumstances oblige you to remain in the. Fee: The reciprocity fee, also known as the visa issuance fee, you must pay. This fee is in addition to the nonimmigrant visa application fee (MRV fee). Number of Entries: The number of times you may seek entry into the United States with that visa.

M means multiple times.

Because of the importance of your passport, we strongly suggest that you send your application and passport to VisaCentral in a secure way, using a traceable courier such as FedEx, UPS. This is a privately owned website and not a government agency. (more…)