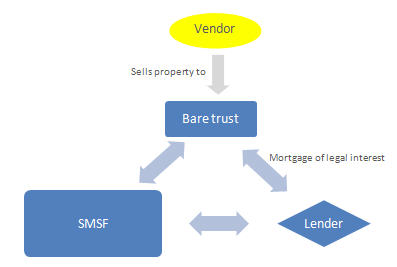

Australia Income Tax Treaty exempts superannuation from U. We can provide a Tax Opinion to secure the legal exemption. The bare trust is merely the registered holder of the property until the loan is repaid. If and when the loan is repaid the legal ownership of the investment property will revert to the trustee of the SMSF.

All property related costs can be paid by the SMSF.

A Bare Trust is set up only if you need to take out a loan (from a bank, a private lender, or any other source). When you’ve identified the property and supplied us with the relevant details, we can set up your bare trust in a matter of hours. Can a bare trustee be a trustee of a trust?

The Bare Trust isolates the property acquired through borrowing from other assets held in the SMSF. Having an Individual Trustee behind the Bare Trust may not be a prudent strategy as an Individual Trustee can die, whereas a Corporate Trustee does not die because a company. Again, this can be organised with your accountant.

Once the declaration has been signed and date your relevant state registry office will need to verify and stamp the trust deed.