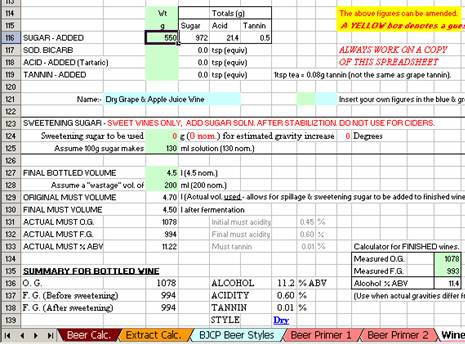

In addition, a Good and Services Tax (GST) of is applicable as well. Corporate Tax Payment Deferment Calculator (XLSX, 28KB) The Corporate Tax Payment Deferment Calculator is designed for companies to view the revised payment due date. The calculator assumes that you own and operate a private limited company that is generating profit and you will receive the post- tax profit as dividend income at the end of the year.

If the tax had kept pace with inflation, instead of 0. Step 2: Enter tax or fee increase for one or more alcohol categories. Enter a ten-cent tax or fee increase for beer as 0.

In the interest of simplicity, some details have been omitted. Your average tax rate is 21. When shipping something internationally, your shipment may be subject to import duties and taxes. These additional charges are calculated based on the item type and its value.

Calculate import duty and taxes in the web-based calculator. BevTax alcohol tax calculator. Federal excise tax and state excise tax for beer, wine and spirits.

Liquor tax for all states in the USA.

Accurate automatic calculations for all tax rates for multiple unit sizes. (more…)