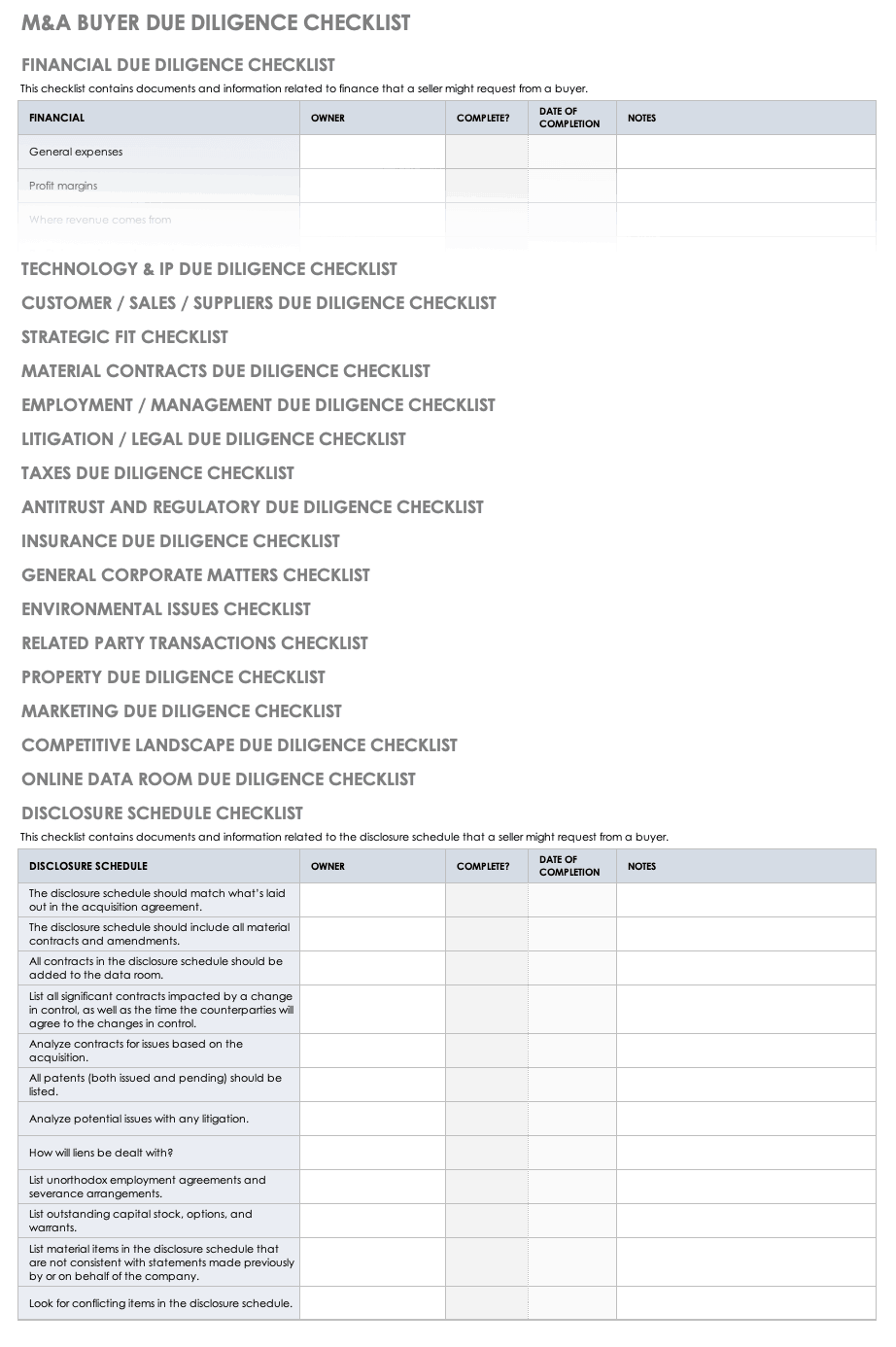

Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! Financial Information A. Annual and quarterly financial information for the past three years 1. Income statements, balance sheets, cash flows, and footnotes 2. Planned versus actual 3. Management financial reports 4. Breakdown of sales and gross profits by: a. The three categories are: PHYSICAL, FINANCIAL, and LEGAL. A checklist for each category has been developed.

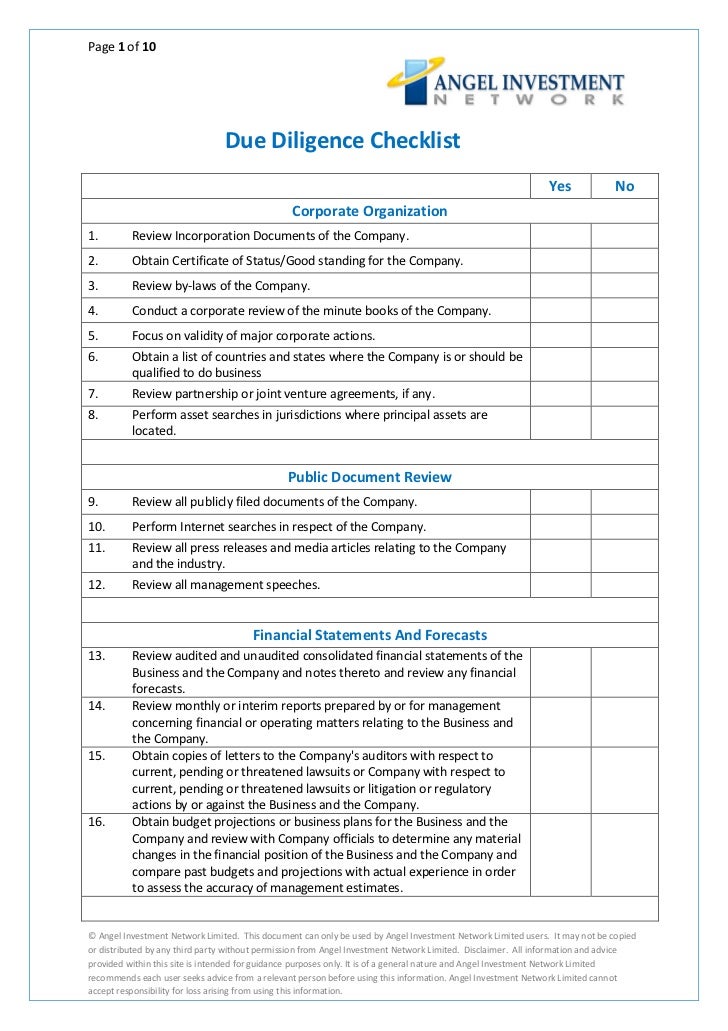

A due diligence checklist helps ensure that the final decision is based on a thorough investigation of all aspects of the business. Project Documentation (a) Have the following documents been provided? What should I review in due diligence? What do I need to know about due diligence? When is due diligence complete?

Additional issues may be appropriate under the circumstances of a particular deal. Due diligence is a process during which a potential buyer of a company investigates that company to gain information to allow it to decide whether to go through with the acquisition. Information concerning finances must also be added to the buyer due diligence checklist. Due Diligence is the act of gathering and evaluating information about a target business.

This aspect of due diligence gives potential buyers a clear vision of a company’s market value. (more…)