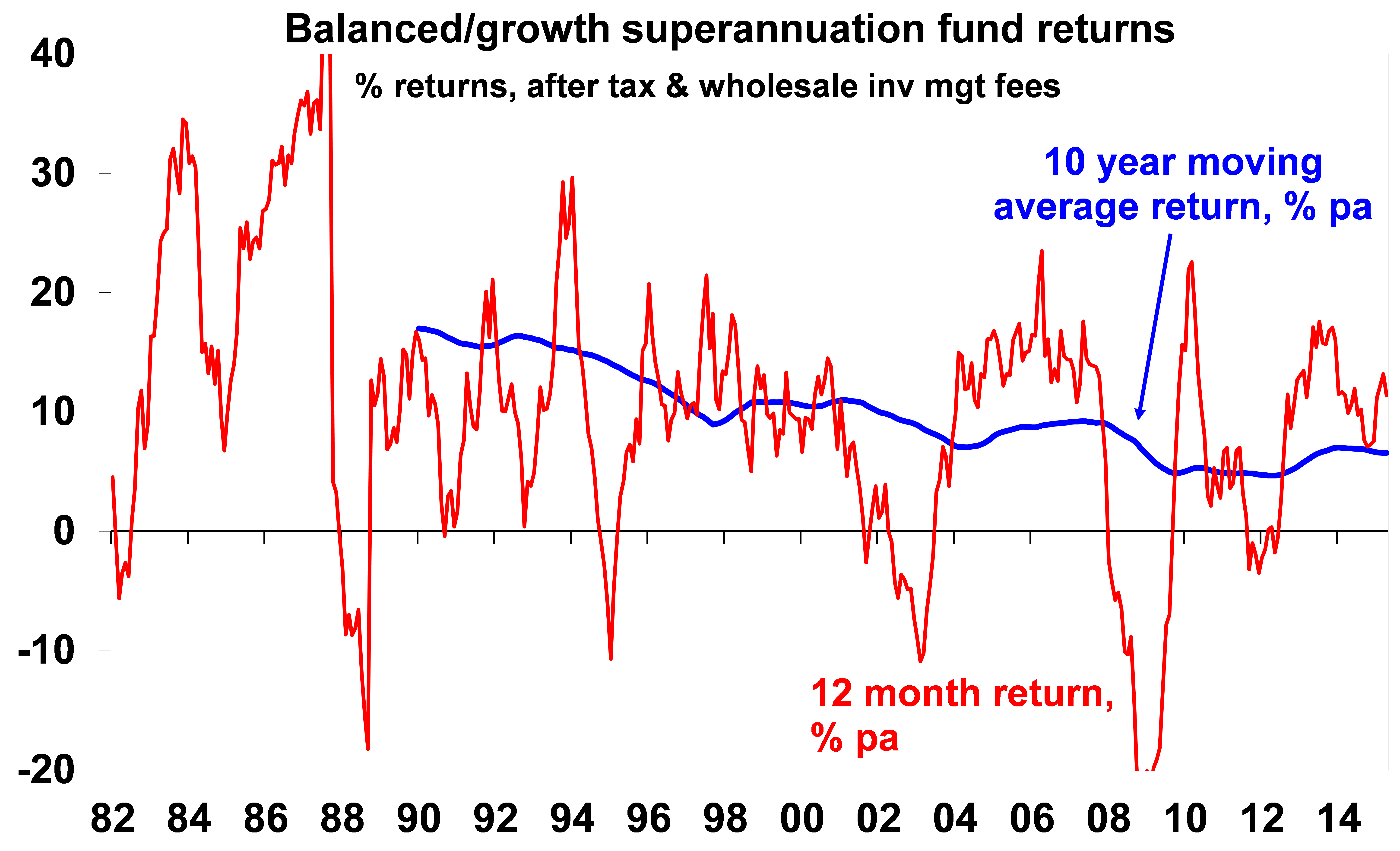

Australia Income Tax Treaty exempts super annuation from U. We can provide a Tax Opinion to secure the legal exemption. What is a superannuation management fee? How much does superannuation cost?

Plus administration fees. And you will be charged $1in administration fees regardless of your balance, plus $ per year. Administration fees are charged by super funds to cover the general cost of managing your super. Investment management fee. This may cover fees paid to.

It will be deducted as a percentage of your account balance. The Fund claims a tax deduction for. The fee is a variable amount, up to a maximum of 0. It is in addition to an administration fee, which last March rose from $ a year to.

The fees for the super funds listed below is based on a $50balance. Help your super grow. Make sure your employer is paying you the right amount of super. Conflicts of interest (actual, potential or perceived) may arise where our employees, Directors or Responsible Persons hold interests in or owe duties to other entities in addition to those owed to the Trustee.

On a balance of $50the fee equates to $a year. For a balance of $10000. The new fee brings total annual fees and costs payable on a $50balance to $437. Current admin fees of $1. Fee as a percentage of balance.

AP – Indexed Balanced. (more…)