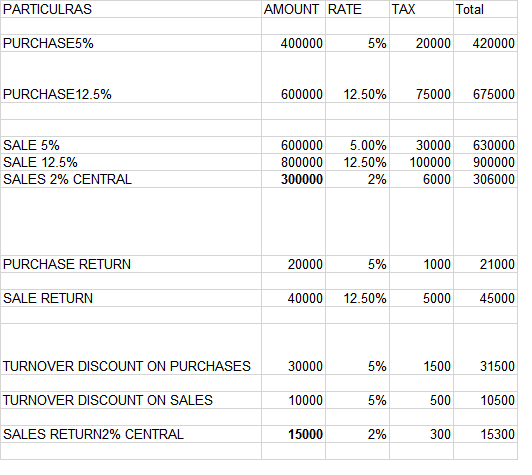

What is a tax exemption for a trust? Can I claim property exemption? Is a trust a complex trust? Do I qualify for a land tax exemption? See full list on hfs.

Transactions involving the first time purchase of farmland property by a young farmeror a young farmer business entity. The young farmer must be under the age of and the land purchased must be used or intended to be used primarily for the business of primary production. A young farmer may have previously owned residential property but cannot have previously owned farmland in order to receive the exemption. The transferor must be a natural person, a trustee for a natural person, or a company in which all the shares are owned by related natural persons.

The transferee must be a relative, a trustee of certain types of trust , or a shareholder of the transferring company. Section 24(1) of the Act provides that dutiable transactions relating to separate items or separate parts of dutiable property are to be aggregated and treated as a single dutiable transaction if: 1. Dutiable transactions occurred within months or contracts of sale are entered into within months, and 2. They together form evidence, give effect to or arise from what is substantially one arrangement relating to all the items or parts of the dutiable property, or 3. (more…)