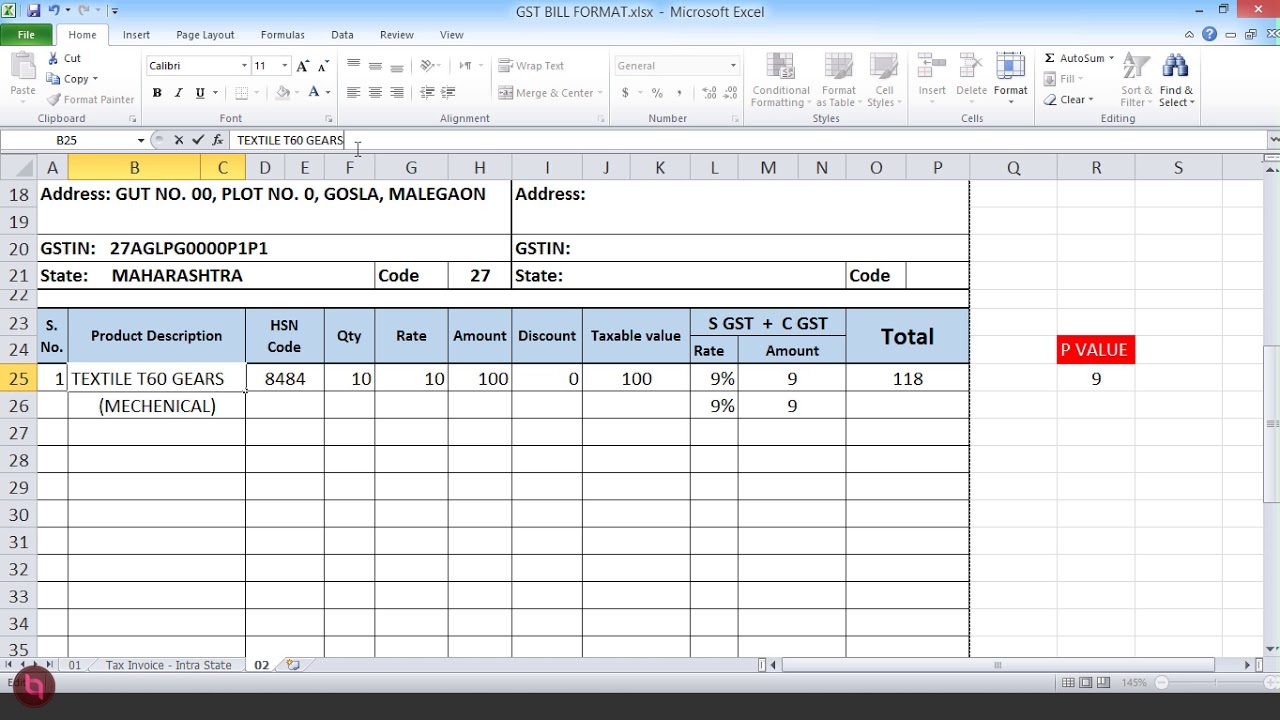

This worksheet allows you to work out GST amounts for your business activity statement (BAS). Don’t lodge the worksheet with your BAS. We recommend you file it with a copy of the BAS it relates to. GST calculation worksheet for BAS (If you want to use the calculation sheet method to work out GST amounts) GST amounts you owe the Tax Office from sales Do not lodge the calculation sheet with your BAS.

Some of the worksheets for this concept are Gst calculation work for bas, Gst rate change adjustment gst 1calculation , Everyday math skills workbooks series, Gst adjustments ir 3calculation , Gs completing your activity statement, Mq maths a yr 1 Achievement objectives description of mathematics, Work. GST previously claimed or paid. The calculation worksheet should not be sent to the Tax Office. It should be kept with periodic reports and other working papers to be reviewed in the event of a Tax Office query.

For best , download and open this form in Adobe. Enter the total of all GST and HST amounts that you collected or that became collectible by you in the reporting period. For business GST – the tax is paid to the Inland Revenue Department (of New Zealand) usually on a or monthly filing period. Answer interactive questions.

Used by million students worldwide. Keep the worksheet in case we ask to see it. (more…)