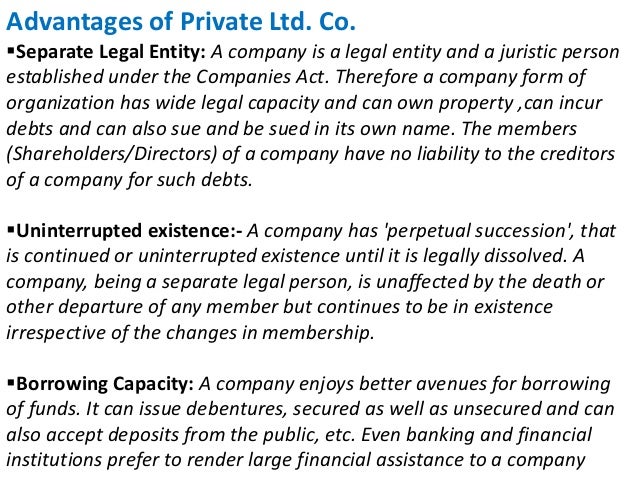

A legal entity , typically a business , that is defined as detached from another business or individual with respect to accountability. A separate legal entity may be set up in the case of a corporation or a limited liability company, to separate the actions of the entity from those of the individual or other company. These use the suffix “CIC”.

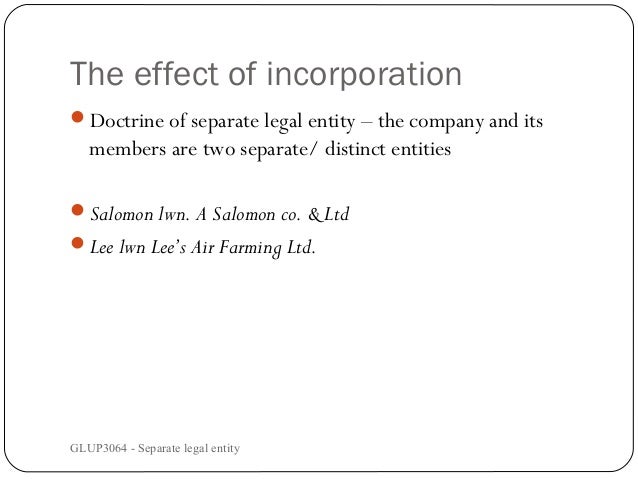

Is a partnership a separate legal entity ? Difference between Sole Proprietors and Companies. In this example, we use a company as a separate legal entity. Separate legal entity means any entity created by interlocal agreement the membership of which is limited to two or more special districts, municipalities, or counties of the state, but which entity is legally separate and apart from any of its member governments. This is confirmed in the House of law in the case of Salomon vs. Limited liability also states that shareholders are not personally liable for their company’s debts.

See full list on lawaspect. This principle enables each company in a corporate group to be treated as a separate legal entity distinct from other companies within the group. This has significant implications in tort cases, wherein tort creditors of a company in a group could only enforce their legal right against the debtor company. To this extent, shareholders of the debtor company are not liable for the company’s debts beyond their initial capital investment.