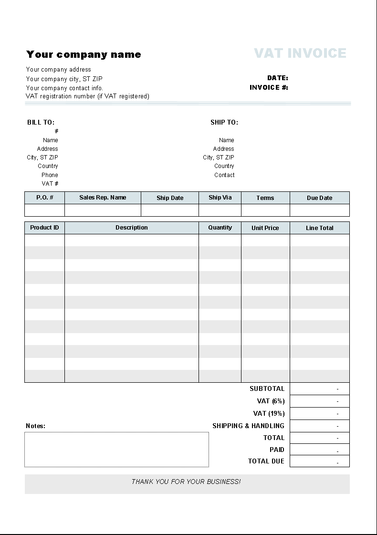

If you are experiencing an issue accessing the ABN application please use this alternative link. The ABN is a unique digit number that identifies your business or organisation to the government and community. Apply or reapply for an ABN using the application below: Apply or reapply for an ABN. Watch this video to find out more about ABNs. If your business or organisation is located outside.

To complete your ABN application – depending on your. Skip to the top of the client summary;. Use myGovID and Relationship Authorisation Manager (RAM) for.

Ensure your client is entitled to an ABN prior to applying. As not everyone is entitled to an ABN External Link, you will be asked a series of questions when applying for one to determine your entitlement. The ABN administers a Loan Program for Alabama residents who are licensed nurses seeking graduate education as a Nurse Practitioner, Nurse Midwife, or Nurse Anesthetist. For further information and application requirements, please visit the Grad Student section of the website.

What is the difference between an ABN and ACN? Can you use an ABN for a commercial payor? Not everyone is entitled to an ABN , so the registration process will ask specific questions to determine your entitlement to an ABN.

RSA Plaza, Suite 25 7Washington Ave. (more…)