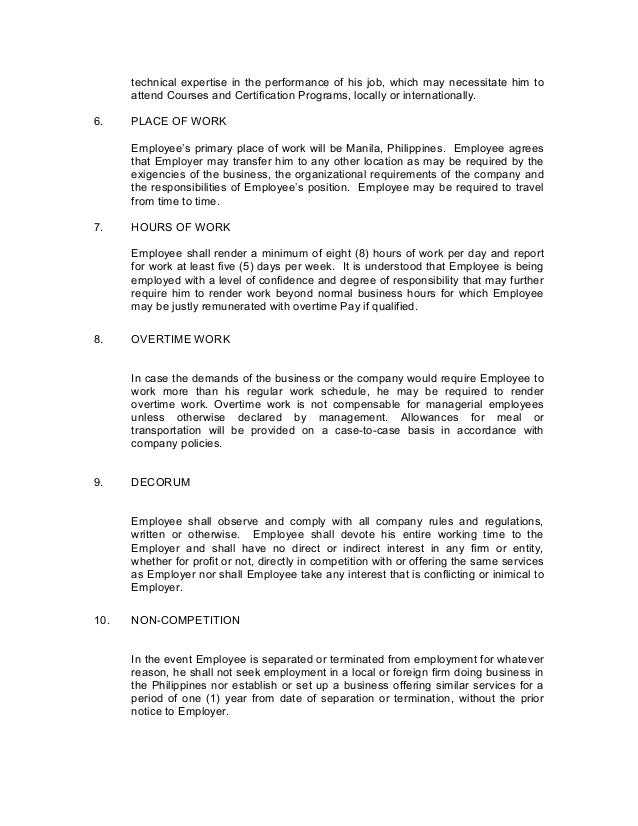

Use this form if you are seeking an early release of your superannuation benefits on the grounds of severe financial hardship. If you are eligible to access your super early and your balance is less than $100 we will be able to release the super amount available in your account (up to $1000). Note: If you have multiple super accounts you will be able to specify in your application a withdrawal amount from each account, up to the maximum amount of $10in total. Financial Hardship claim – use this form if you are seeking an early release of your superannuation benefits on the grounds of severe financial hardship.

Here you may find forms to help you arrange a transaction or update the details of your investment. We use cookies to secure and tailor your web use. Our notice explains how we use cookies and how you can manage them. If you withdraw super due to severe financial hardship it is taxed as a super lump sum.

The minimum amount that can be withdrawn is $0and the maximum amount is $1000. If your super balance is less than $0you can withdraw up to your remaining balance after tax. You can only make one withdrawal in any 12-month period. If you do not qualify for early release of your super benefit on the grounds of severe financial hardship , you may enquire about the release of some or all your benefits on compassionate grounds through the Australian Taxation Office (ATO).